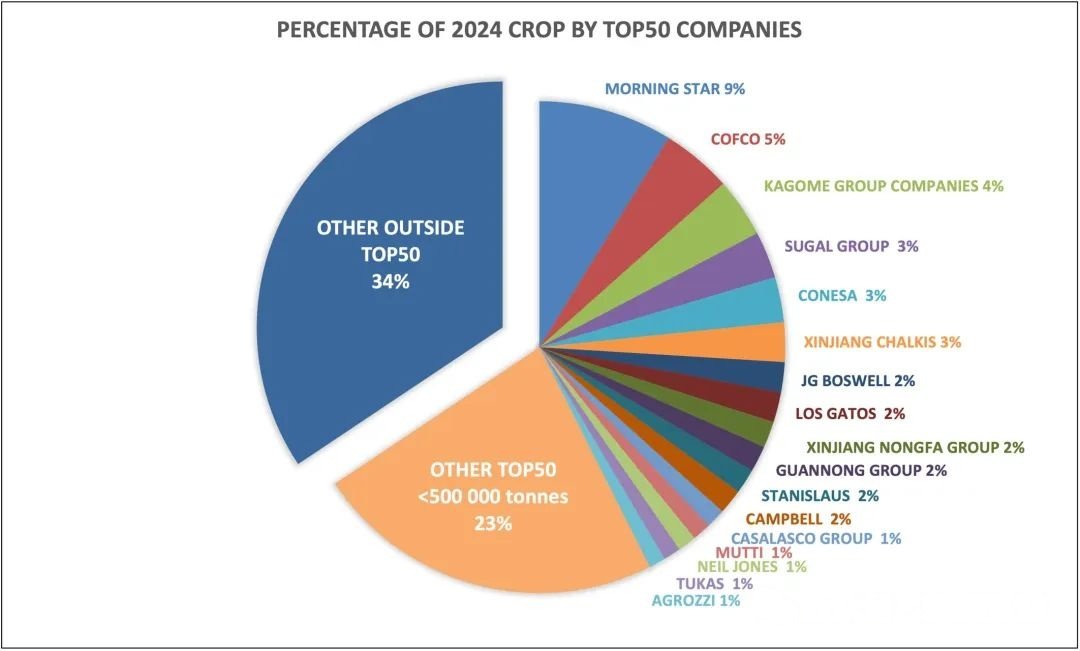

Based on data collected through direct contact with processing companies and industry experts worldwide, the top 50 global tomato processing companies (for which we have direct or estimated data) processed 30 million metric tons of tomatoes in 2024. This accounts for two-thirds of the global total processed volume, approximately 45.8 million metric tons.

Let’s have a look below at the top 50 Global Tomato Processing Companies in 2024

- MORNING STAR ( USA / 4,800,000 MT )

- COFCO ( CHINA / 2,100,000 MT )

- KAGOME GROUP ( JAPAN / 1,800,000 MT )

- SUGAL GROUP ( PORTUGAL / 1,400,000 MT )

- CONESA ( SPAIN / 1,300,000 MT )

- XINJIANG CHALKIS ( CHINA / 1,200,000 MT )

- JG BOSWELL ( USA / 900,000 MT )

- LOS GATOS ( USA / 900,000 MT )

- XINJIANG HONGFA ( CHINA / 800,000 MT )

- GUANNONG GROUP ( CHINA / 800,000 MT )

- STANISLAUS ( USA / 750,000 MT )

- CAMPBELL ( USA / 750,000 MT )

- CASALASCO GROUP ( ITALY / 580,000 MT )

- MUTTI ( ITALY / 560,000 MT )

- NEIL JONES ( USA / 560,000 MT )

- TUKAS ( TURKEY / 520,000 MT )

- AGROZZI ( CHILE / 500,000 MT )

- CONAGAR ( USA / 500,000 MT )

- AGROFUSION ( UKRAINE / 460,000 MT )

- INNER MONGOLIA FUYONG ( CHINA / 440,000 MT )

- CONSERVE ITALIA ( ITALY / 440,000 MT )

- PCP ( USA / 430,000 MT )

- TAT KONSERVE ( TURKEY / 420,000 MT )

- XINJIANG RISING SUN ( CHINA / 400,000 MT )

- RED GOLD ( USA / 400,000 MT )

- TOMATES DEL GUADIANA ( SPAIN / 390,000 MT )

- CARGILL ALIMENTOS ( BRAZIL / 380,000 MT )

- KRAFT HEINZ BRASIL ( BRAZIL / 370,000 MT )

- STERILTOM ( ITALY / 370,000 MT )

- PREDILECTA ( BRAZIL / 340,000 MT )

- WEISHENG TIANTONG ( CHINA / 330,000 MT )

- PATAGONIA FRESH ( CHILE / 330,000 MT )

- SICAM ( TUNISIA / 320,000 MT )

- TACHENG HONGXIANG ( CHINA / 310,000 MT )

- P&J FOR JUICE AND PASTE ( EGYPT / 310,000 MT )

- TIANCHENG TOMTO ( CHINA / 300,000 MT )

- PRONAT ( SPAIN / 290,000 MT )

- LA DORIA ( ITALY / 280,000 MT )

- SULTAN ( TURKEY / 250,000 MT )

- DEL MONTE ( USA / 250,000 MT )

- XINJIANG XINQIE FOOD ( CHINA / 240,000 MT )

- TRANSA ( SPAIN / 230,000 MT )

- RODOLFI MANSUETO ( ITALY / 230,000 MT )

- ESCALON ( USA / 230,000 MT )

- TOMALIA ( SPAIN / 220,000 MT )

- SOCODAL ( TUNISIA / 220,000 MT )

- NOMIKOS ( GREECE / 220,000 MT )

- BURCU ( TURKEY / 210,000 MT )

- ALSAT ( SPAIN / 200,000 MT )

- SUN-BRITE FOODS ( CANADA / 200,000 MT )

Morning Star Company retained its top position, processing over 4 million metric tons across its three California-based facilities—nearly double the volume of China’s COFCO, the second-ranked company, which processed 2.12 million metric tons across 12 Chinese plants. The next three spots were held by the only companies with factories spanning multiple continents: Kagome, Sugal, and Conesa. These five companies, along with China’s Xinjiang Chalkis, each processed over 1 million metric tons annually, collectively accounting for 11.9 million metric tons (over 25% of the global total).

The next 11 companies processed between 500,000 and 1 million metric tons each (total: 7.6 million metric tons), followed by 19 companies processing 300,000–500,000 metric tons each (total: 7.2 million metric tons). The 50th-ranked company processed 210,000 metric tons, confirming our initial hypothesis that 200,000 metric tons is the threshold for inclusion.

This year’s list features 11 new entrants, including 4 from China and 2 from Brazil.

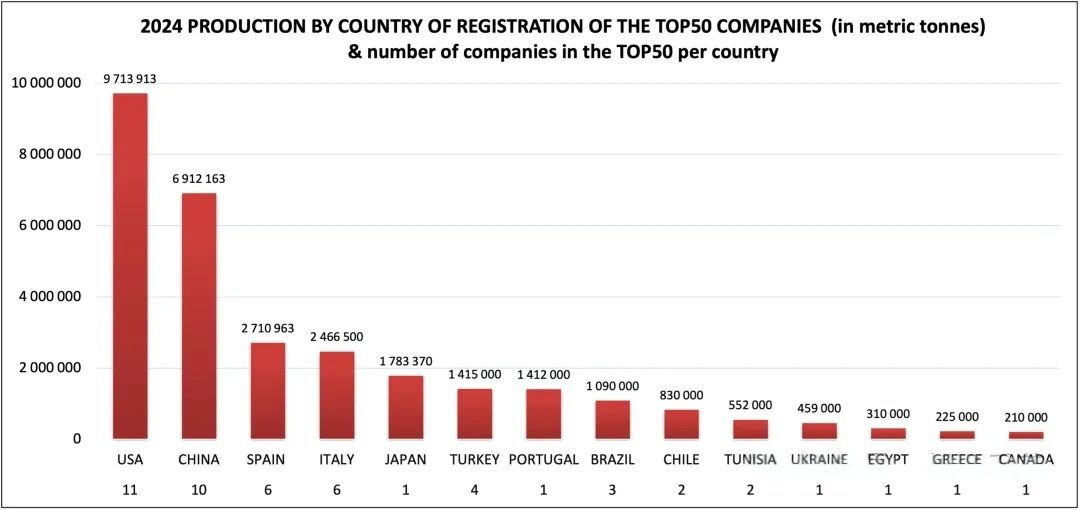

Geographic Distribution:

- United States: 11 companies (10 in California).

- China: 10 companies.

- Europe: Majority of remaining companies.

- South America (Brazil/Chile): 5 companies.

- North Africa (Tunisia/Egypt): 3 companies.

- Asia: Only Kagome (Japan), though most of its processing occurs outside Asia.

These 50 companies are headquartered in 14 countries and operated 151 processing plants across 17 nations in 2024, with only 15 plants located in the Southern Hemisphere. Their combined capacity exceeded 38 million metric tons, far surpassing actual production even in a record year like 2024.

Top 5 Companies:

-

Morning Star (USA)

- Rank: #1

- Factories: 3 (all in California, USA)

- 2024 Volume: 4 million metric tons.

-

COFCO (China)

- Rank: #2

- Factories: 12 (all in China)

- 2024 Volume: 2.12 million metric tons.

-

Kagome Group (Japan)

- Rank: #3

- Factories: 6 (Australia, Italy, Portugal)

- 2024 Volume: 1.73 million metric tons.

-

Sugal Group (Portugal)

- Rank: #4

- Factories: 5 (Portugal, Spain, Chile)

- 2024 Volume: 1.41 million metric tons.

-

Conesa (Spain)

- Rank: #5

- Factories: 9 (China, California)

- 2024 Volume: 1.36 million metric tons.

Factory Count Insights:

- Highest: COFCO (12 factories), followed by Conesa (9).

- Lowest: 15 companies (e.g., Del Monte, Tomalia) have only 1 factory.

- Efficiency: Factory count doesn’t directly correlate with output. Morning Star’s 3 factories outperformed COFCO’s 12, highlighting the role of scale and efficiency.

Country-Level Factory Distribution:

- USA: 11 companies (e.g., Morning Star, JG Boswell).

- China: 10 companies (e.g., COFCO, Xinjiang Chalkis).

- Italy: Multiple companies (e.g., Casalasco Group, Mutti).

- Others: Portugal (Sugal), Spain (Conesa), Brazil (Cargill, Kraft Heinz).

Summary:

- Total factories: 151 (average: 3 per company).

- Concentration: 136 in Northern Hemisphere; 15 in Southern Hemisphere.

- Globalization: Top 5 includes Kagome, Sugal, and Conesa with multi-continent operations, while Morning Star and COFCO remain country-focused.