Are your traditional markets becoming saturated? Relying on old markets means missing out on the world's fastest-growing regions and your next big opportunity for growth.

Significant opportunities exist in emerging markets, particularly in Southeast Asia, Africa, and Latin America. This growth is driven by rising populations, increasing meat consumption (fueling the animal feed sector), and government-led food fortification programs.

I constantly analyze global trends for my clients. A forward-thinking buyer knows that identifying tomorrow's growth markets is key to long-term success. While Europe and North America remain stable, real, dynamic growth is happening elsewhere. Let's explore where these opportunities lie.

Which regions need more Vitamin A?

Are you unsure where to focus your company's expansion efforts? It is vital to target the regions with the highest potential.

The regions with the greatest growing need for Vitamin A are Southeast Asia, Sub-Saharan Africa, and parts of Latin America. Their rapidly expanding animal feed industries and increasing focus on fortified foods create a powerful and sustainable demand.

The growth story for Vitamin A is in the developing world. In Southeast Asia1 (e.g., Vietnam, Indonesia), rising incomes are boosting meat consumption, which directly fuels massive growth in the animal feed industry2. In Africa and Latin America, a primary driver is government-led food fortification programs. The mandatory addition of Vitamin A to staple foods like cooking oil and flour creates a large-scale, reliable demand based on national health policy.

Regional Growth Drivers:

| Region | Primary Driver for Vitamin A Demand | Key Countries (Examples) |

|---|---|---|

| Southeast Asia | Rapid growth in the animal feed industry. | Vietnam, Indonesia, Philippines |

| Africa | Food fortification programs, growing poultry sector. | Nigeria, Ethiopia, Kenya |

| Latin America | Professionalizing feed industry, food fortification. | Brazil, Mexico, Colombia |

How do population trends affect Vitamin A?

You see the global population numbers, but they seem abstract. How do these big demographic shifts translate into real business opportunities for Vitamin A?

Population trends are the fundamental driver of demand. A growing global population requires more food, while urbanization and a rising middle class lead to dietary shifts toward more meat, dairy, and processed foods, all of which significantly increase Vitamin A consumption.

Population shifts are the key to predicting future demand. The most important trend is the rise of the global middle class, which leads to a massive increase in meat and dairy consumption. Since over 80% of Vitamin A is used in animal feed, this is the single biggest driver of growth. Other key trends include overall population growth3 (more mouths to feed) and urbanization, which increases the consumption of processed and fortified foods.

Key Population Trends and Their Impact:

| Population Trend | Consequence | Impact on Vitamin A Demand |

|---|---|---|

| Rising Middle Class | Increased consumption of meat and dairy. | Massive growth in the animal feed sector. |

| Urbanization | Higher consumption of processed foods. | Growth in the food fortification sector. |

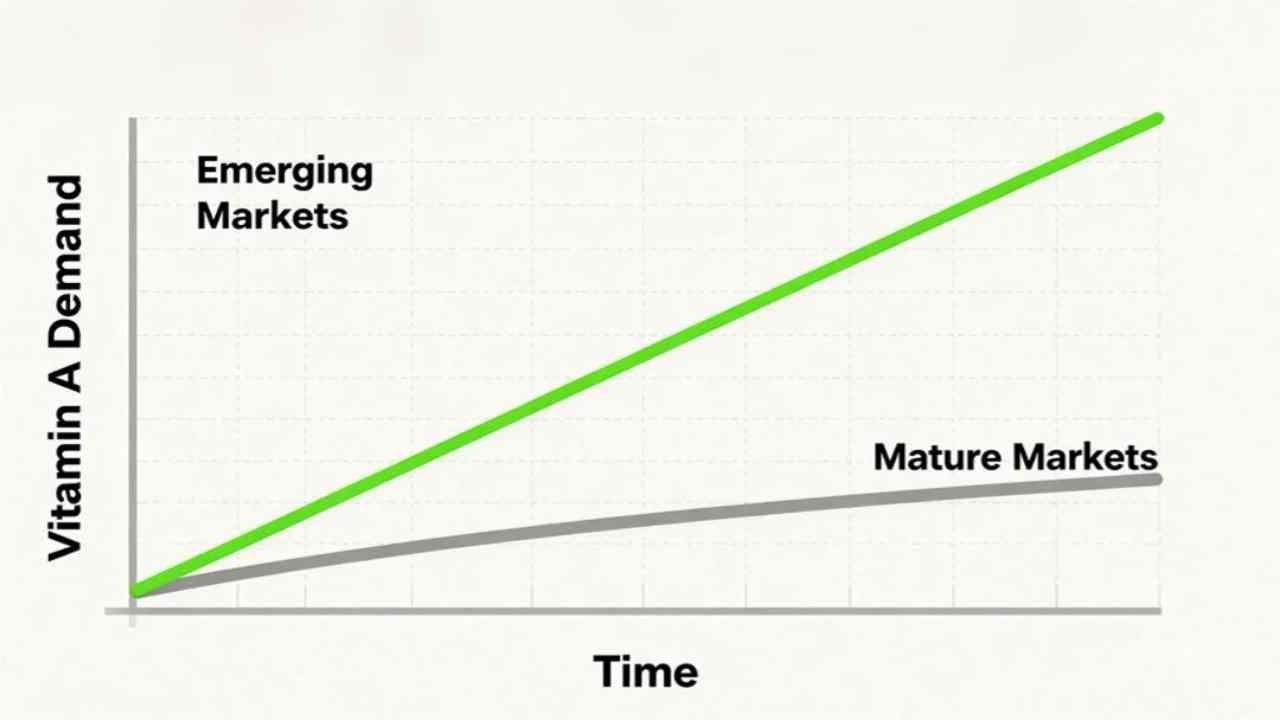

Why are emerging markets good for Vitamin A?

You know that entering new markets is a challenge. Are the rewards of focusing on emerging markets really worth the effort?

Emerging markets are the best opportunity because their demand is increasing much faster than in mature markets. They have developing industries and less entrenched competition, creating a "blue ocean" for high-quality suppliers to establish a strong, long-term position.

You have to go where the growth is. Mature markets4 in Europe and North America are saturated, with slow growth and intense competition. Emerging markets5, in contrast, are still building their industries. Their local feed mills and food processors are growing and modernizing, creating a huge opportunity for reliable international suppliers to get in on the ground floor. You can grow alongside your customers and build deep, loyal relationships that last for decades.

Market Comparison:

| Feature | Mature Markets (e.g., EU, North America) | Emerging Markets (e.g., Southeast Asia, Africa) |

|---|---|---|

| Demand Growth Rate | Low (0-2% per year) | High (5-10%+ per year) |

| Competition | Intense, dominated by established players. | Less intense, open to new suppliers. |

| Growth Potential | Limited. Focus is on maintaining share. | Huge. Focus is on capturing new demand. |

What challenges exist for Vitamin A suppliers?

You see the opportunity, and you are ready to sell in a new country. What are the real-world hurdles you need to overcome?

The main challenges for suppliers are navigating complex and varied import regulations, overcoming logistical gaps, managing payment risks, and building trust with new customers from a distance. Each new market presents a unique set of hurdles.

Entering new markets requires a clear strategy to overcome challenges. First is the regulatory maze6; every country has unique import rules, and a mistake can lead to costly delays. Second are logistical hurdles, as infrastructure like ports and roads may be less developed. Finally, the biggest challenge is building trust from a distance, which is essential to overcome a new buyer's hesitation to send a large payment overseas.

Overcoming Market Entry Challenges:

| Challenge | Solution |

|---|---|

| Complex Regulations | Work with a partner who has specific expertise in the target country's rules. |

| Logistics Infrastructure | Partner with experienced freight forwarders with strong local networks. |

| Building Trust / Payment Risk | Be transparent, welcome inspections, and offer secure payment terms (L/C). |

How to grow Vitamin A distribution networks?

You are based in China. How do you effectively reach an entire new market and achieve deep penetration?

The most effective way to grow a distribution network is by forming strong partnerships with reputable local distributors. These partners provide the essential local market knowledge, customer relationships, warehousing, and sales force needed to reach the end-users.

Direct sales are not scalable in new markets. The key is to partner with a strong local distributor7. A good distributor acts as your sales team, logistics hub, and source of market intelligence all in one. They have existing customer relationships and understand the local business culture. Choosing the right partner—one with a strong reputation, relevant experience, and a shared vision for quality—is the fastest and most effective route to market success.

The Supplier-Distributor Partnership:

| Supplier's Responsibility (FINETECH) | Distributor's Responsibility (Local Partner) |

|---|---|

| Provide consistent, high-quality product. | Manage local sales and customer relationships. |

| Offer competitive pricing and a stable supply. | Handle local warehousing and logistics. |

| Provide technical support. | Provide market intelligence and sales forecasts. |

Conclusion

The greatest opportunities for Vitamin A are in emerging markets. Success requires a strategic approach that navigates challenges by building strong, trust-based partnerships with local distributors.

-

Explore this link to understand how rising incomes in Southeast Asia are transforming markets and industries. ↩

-

This resource will provide insights into the booming animal feed industry and its significance in global agriculture. ↩

-

Exploring this topic reveals critical insights into future food security and agricultural strategies. ↩

-

Understanding the challenges of mature markets can help you strategize effectively for growth. ↩

-

Exploring opportunities in emerging markets can reveal potential for significant growth and partnerships. ↩

-

Understanding the regulatory maze is crucial for navigating import rules effectively and avoiding costly mistakes. ↩

-

Exploring this link will provide insights into how local distributors can enhance your market entry strategy. ↩