Struggling with rigid payment terms that hurt your cash flow? This makes it hard to manage inventory and grow your business, putting you at a competitive disadvantage.

The most common payment terms are Telegraphic Transfer (T/T), typically a 30% deposit with a 70% balance, and Letters of Credit (L/C) for high-value orders. Flexible terms are earned over time through a trusted, reliable partnership with your supplier.

In any deal, after we agree on quality and price, the next critical discussion is payment terms. For a professional buyer, this is a key part of his financial strategy. The payment terms we agree on are weh. can limit your business. A professional partner works with you to find a win-win solution that helps both our businesses grow stronger together.

Which Payment Methods Are Used for Potassium Sorbate Orders?

Are you confused by terms like T/T, L/C, and D/P? Choosing the wrong one can lead to high bank fees, long delays, or unnecessary financial risk.

The most widely used method is the Telegraphic Transfer (T/T), usually with a deposit. For new relationships or very large orders, a Letter of Credit (L/C) provides security. Documents Against Payment (D/P) is rare and reserved for long-standing, trusted partners.

Choosing the right method balances speed, cost, and security. Telegraphic Transfer (T/T)1 is the standard; it is fast, cheap, and usually involves a 30% deposit and 70% balance. A Letter of Credit (L/C) is a bank guarantee that offers maximum security for both sides but is slow and has high fees, making it best for very large orders. Documents Against Payment (D/P) is a high-risk method for the supplier, so it is only used with the most trusted, long-term partners.

Payment Method Comparison:

| Method | Speed | Cost | Security (for Buyer) | Security (for Supplier) |

|---|---|---|---|---|

| Telegraphic Transfer (T/T) | Fast | Low | Fair | Good (with deposit) |

| Letter of Credit (L/C) | Slow | High | Excellent | Excellent |

| Documents Against Payment (D/P) | Fair | Low | Good | Very Low |

How Can Buyers Request Flexible Payment for Potassium Sorbate?

Is your cash flow being squeezed by suppliers who demand 100% of the payment upfront? This makes it almost impossible to buy in bulk and grow your business.

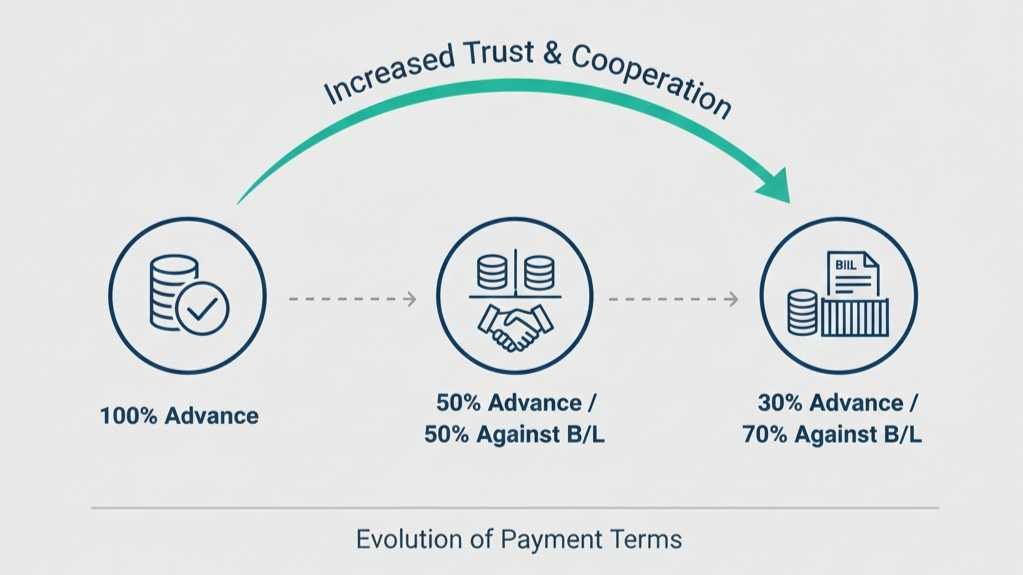

Buyers can earn flexible payment terms by building a track record of reliability. After successfully completing several orders with on-time payments, a supplier will gain the trust needed to offer better terms, such as paying the balance after shipment.

Flexibility is earned through trust. While a new customer might have stricter terms, a proven partner can get better conditions that significantly improve their cash flow2. The goal for most buyers is a term like "30% deposit, 70% balance against B/L copy3." This frees up capital during the production and shipping phases. You can achieve this by demonstrating your reliability through a history of consistent orders and on-time payments, building a ladder of trust with your supplier.

The Ladder of Trust for Payment Terms:

| Trust Level | Common Payment Term | Buyer's Cash Flow Impact |

|---|---|---|

| New Customer | 30% Deposit, 70% Balance before shipment | Poor |

| Proven Partner | 30% Deposit, 70% Balance against B/L copy | Good |

| Strategic Partner | D/P or other credit terms | Excellent |

What Are the Risks of Different Potassium Sorbate Payment Terms?

Every payment term has a risk. Do you know where the risk lies for you as the buyer, and for me as the supplier? Understanding this is key to a fair negotiation.

For the buyer, the biggest risk is paying for goods and not receiving them (high with T/T advance). For the supplier, the biggest risk is shipping goods and not getting paid (high with D/P or credit terms).

Every payment term is a negotiation about who carries the risk. The buyer's main risk4 is payment without delivery, which is highest with a 100% T/T advance. The supplier's main risk is delivery without payment, which is highest with D/P or credit terms. The industry standard, 30% deposit with 70% balance against B/L copy, is a fair compromise that balances the risk for both parties. A Letter of Credit (L/C) uses banks to eliminate risk but is slow and expensive.

The Balance of Risk in Payment Terms:

| Payment Term | Who Holds the Primary Risk? | Notes |

|---|---|---|

| 100% T/T in Advance | Buyer | High risk for the buyer, only use with trusted suppliers. |

| 30% Deposit / 70% against B/L | Balanced | A fair compromise, the industry standard. |

| Letter of Credit (L/C) | Bank (Balanced) | Eliminates risk for both, but is slow and expensive. |

| D/P or Open Account | Supplier | High risk for the supplier, only for trusted partners. |

When Are Credit Terms Offered for Potassium Sorbate?

Are you hoping to get "buy now, pay 30 days later" credit terms from your overseas supplier? This is the ideal situation for a buyer's cash flow, but it is extremely rare.

Credit terms, also known as Open Account (OA), are only offered to top-tier, long-standing partners. It requires a multi-year relationship, a history of high volume, a perfect payment record, and often requires the supplier to purchase credit insurance.

Credit terms (Open Account) are the highest level of trust and are very rare in international trade. It means you get the goods first and pay 30-60 days later. From my perspective as a supplier, this is a huge risk, like giving an unsecured loan. Therefore, credit is only ever considered for the very best strategic partners who meet strict criteria: a multi-year relationship, consistent high volume, and a perfect payment history. Often, I must also purchase expensive credit insurance5, which requires the buyer to pass a strict credit check.

Requirements for Credit Term Consideration:

| Requirement | Description |

|---|---|

| Relationship History | Multi-year partnership with a proven track record. |

| Volume | Consistent, high-volume orders (multiple containers per year). |

| Payment Record | A perfect history of 100% on-time payments. |

| Credit Rating | The buyer's company must pass a strict third-party credit check. |

How Do Payment Terms Affect Potassium Sorbate Cooperation?

Is your negotiation over payment terms always a fight? When each side only pulls for their own interest, it creates a toxic relationship that is bad for business.

Payment terms are a direct reflection of the business relationship. Fair, mutually agreed-upon terms build a foundation of trust, leading to a smooth, efficient, and cooperative partnership. Unfair or inflexible terms create friction and prevent any true strategic collaboration.

Payment terms define your relationship with your supplier. An adversarial, "zero-sum" negotiation leads to a low-trust, transactional relationship. A professional, collaborative approach, however, builds a true partnership. By starting with fair, standard terms and proving mutual reliability, trust grows. This high-trust relationship allows for more flexibility over time and leads to benefits beyond just payment terms, such as priority support during market shortages and valuable market insights.

Transactional vs. Partnership Approach:

| Aspect | Transactional (Low Trust) | Partnership (High Trust) |

|---|---|---|

| Negotiation Style | Adversarial, zero-sum. | Collaborative, win-win. |

| Payment Terms | Rigid and inflexible. | Evolve over time to become more flexible. |

| Cooperation | Minimal. Limited to the single transaction. | High. Includes market insights, priority support. |

| Long-Term Outcome | Stressful, inefficient, easily broken. | Smooth, profitable, and resilient. |

Conclusion

Payment terms are the foundation of a trading relationship. Fair terms, built on mutual trust, create a strong partnership that leads to long-term success for both parties.

-

Explore this link to understand the benefits and process of T/T, a fast and cost-effective payment method. ↩

-

Understanding cash flow strategies can help you manage your finances better and ensure your business thrives. ↩

-

Exploring this payment term can clarify its benefits and how it can optimize your financial operations. ↩

-

Understanding the buyer's main risk helps in negotiating better payment terms and minimizing potential losses. ↩

-

Understanding credit insurance is crucial for suppliers to mitigate risks associated with open account terms. ↩