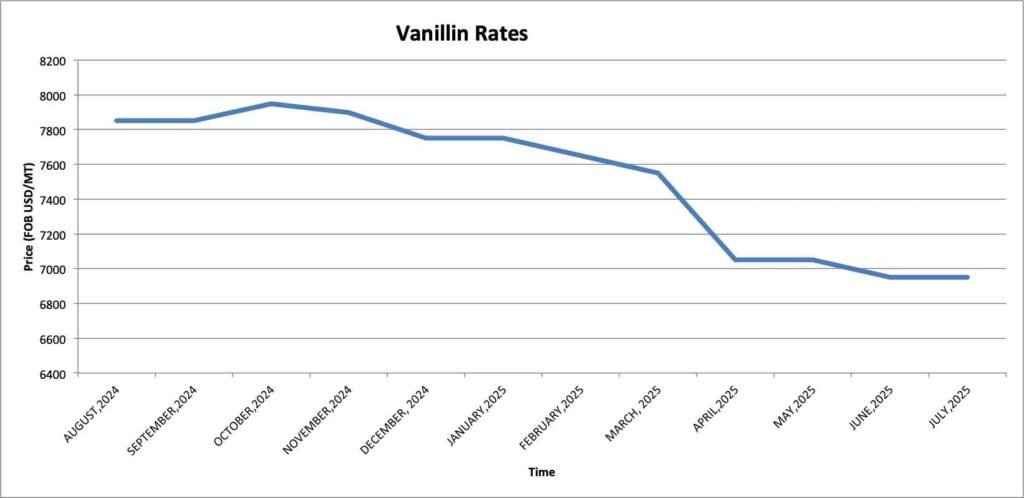

Struggling to budget with unpredictable vanillin costs? Worried that price spikes are destroying your margins? The market is volatile, but the reasons are not a mystery.

Vanillin prices are changing due to fluctuating raw material costs linked to petroleum, volatile global energy prices, consistent food industry demand, and currency exchange rate movements. These factors create a dynamic pricing environment for buyers.

I discuss prices with my clients every day. They know that vanillin’s price is not random; it results from global economic forces. Understanding these forces is key to building a strategic purchasing plan. Let's break down exactly what drives vanillin’s price.

What factors cause Vanillin price fluctuations?

Do you feel like vanillin prices move without any warning? Let's identify the real causes.

Vanillin price fluctuations are primarily caused by three things: the cost of its core raw material (guaiacol), which is linked to oil prices; sudden supply shocks from factory shutdowns; and shifts in global demand.

The price of synthetic vanillin is driven by a few key factors. The most important is the raw material1 cost. The primary ingredient, guaiacol, is a petroleum product, so its price follows the volatile crude oil market. The second factor is supply shocks2. Strict environmental regulations in China can cause factories to shut down unexpectedly, removing supply from the market and causing prices to spike. Lastly, the steady global demand from the food industry creates a strong price floor.

Key Price Flucuation Factors:

| Factor | Source | Impact on Price | Predictability |

|---|---|---|---|

| Raw Material Cost | Global Crude Oil and Petrochemical Market | Direct, significant impact. The largest cost component. | Medium |

| Supply Shocks | Government Environmental Regulations | Sudden, sharp price spikes due to scarcity. | Low |

| Global Demand | Food & Beverage Industry Growth | Gradual upward pressure on price over time. | High |

How do energy costs influence Vanillin pricing?

You have accounted for raw material costs, but the price is still higher than you expected. The factory's energy bill is a huge, often overlooked factor.

Vanillin production is an energy-intensive chemical process. The cost of electricity and natural gas is a significant part of the final price. When global energy markets are volatile, this cost is passed on to the buyer.

Vanillin production requires high heat and pressure, consuming a massive amount of electricity and natural gas. This makes energy the factory's second-largest expense after raw materials. When global energy prices rise due to geopolitical events or market strains, the factory's operational costs increase directly. This added cost is then reflected in the final vanillin price, even if the raw material price has remained stable.

Energy Cost Impact on Final Price:

| Cost Component | Low Energy Price Scenario (per kg) | High Energy Price Scenario (per kg) | Comments |

|---|---|---|---|

| Raw Materials | $8.00 | $8.00 | Raw material price is stable in this example. |

| Energy Costs | $1.50 | $3.00 | Energy price doubles due to a market shock. |

| Final Price | $12.00 | $13.50 | The final price increases by over 12%. |

Does demand from the food industry push Vanillin prices higher?

Supply seems stable, but the price keeps creeping up. Are you competing against unseen forces for your ingredients? Let's look at the powerful role of demand.

Yes, the massive and consistent demand from the global food industry creates a strong price floor. While demand is generally stable, seasonal peaks and new product trends can create temporary tightness in the market, pushing prices higher.

Vanillin is a staple flavor in countless products, from bakery and dairy to beverages. This creates a huge and constant global demand3. This demand is also "inelastic." Because vanillin is a tiny fraction of a final product's cost, food manufacturers will continue to buy it even when prices rise. They simply absorb the cost. This consistent, inelastic demand gives producers the power to pass on cost increases and creates a solid floor under the market price.

Demand Drivers by Food Sector:

| Food Sector | Demand Pattern | Key Use |

|---|---|---|

| Bakery & Confectionery | Stable & Seasonal | Cakes, biscuits, chocolate, candy |

| Dairy | Stable & Seasonal | Ice cream, yogurt, flavored milk |

| Beverages | Growing | Sodas, flavored coffees, nutritional drinks |

How does currency exchange affect Vanillin cost for importers?

Your supplier's USD price has not changed, but your last invoice was more expensive. This hidden cost is likely coming from the currency market.

Vanillin is traded globally in US dollars. If an importer's local currency weakens against the USD, their final cost for the product increases in their local currency, even if the factory's USD price remains the same.

Vanillin is traded internationally in US dollars (USD). If you are an importer in a country that uses the Euro, Riyal, or any other currency, you face currency risk4. For example, if the USD strengthens against your local currency, you will need to spend more of your money to buy the same number of US dollars to pay the invoice. The factory's price in USD has not changed, but your final cost in your local currency has gone up. This is a real cost increase that the importer must manage.

Currency Impact on a $15,000 USD Order:

| Importer's Local Currency | USD to Local Rate | Final Cost in Local Currency | Change in Cost |

|---|---|---|---|

| Euro (EUR) | 1 USD = 0.91 EUR | €13,650 | Baseline |

| Euro (EUR) | 1 USD = 0.95 EUR | €14,250 | + €600 |

What strategies help buyers secure competitive Vanillin prices?

Feeling powerless against all these market forces? With the right strategy, you can take control and secure better, more predictable prices.

To secure competitive prices, buyers should consolidate orders to purchase in larger volumes, sign long-term contracts during market lulls to lock in favorable rates, and build a strong partnership with a transparent supplier.

There are three key strategies to manage price. First, leverage your volume5 by consolidating your demand and ordering in full container loads (FCL) to get a better price per kilogram. Second, sign long-term contracts (6-12 months) when the market is stable to lock in a fixed price and protect your business from future spikes. Finally, build a strong partnership with a supplier who provides market intelligence. This helps you make informed decisions on when to buy and how to navigate the market.

Strategic Purchasing Approaches:

| Strategy | Description | Key Benefit |

|---|---|---|

| Volume Consolidation | Placing larger, less frequent orders (e.g., FCL). | Lower price per kilogram and lower freight costs. |

| Long-Term Contracting | Agreeing on a fixed price for a set volume over 6-12 months. | Complete price stability and guaranteed supply. |

| Strategic Partnership | Working with a supplier who provides market insights. | Informed decision-making and early warnings. |

Conclusion

Vanillin prices are shaped by industrial costs, market forces, and global economics. Understanding these drivers is the first step toward managing your purchasing strategically and controlling your costs.

-

Understanding raw material pricing is crucial for grasping market dynamics and making informed decisions. ↩

-

Exploring supply shocks can provide insights into market volatility and help anticipate price changes. ↩

-

Exploring global demand factors can provide insights into market trends and consumer behavior, essential for strategic business planning. ↩

-

Understanding currency risk is crucial for importers to manage costs effectively and mitigate financial losses. ↩

-

Exploring this link will provide insights on how volume leverage can optimize costs and improve efficiency. ↩