Worried about cash flow? Rigid payment terms can make it impossible to buy the stock you need, hurting your business growth and ability to compete.

Payment terms directly affect a buyer's cash flow, risk, and the total cost of a transaction. The right terms build trust and create a strong, mutually beneficial partnership between the buyer and the supplier, enabling smoother, more frequent trade.

After quality and price, payment terms are the most important part of any negotiation. For a professional buyer, this is a core part of their financial strategy. A payment term reflects the level of trust between a buyer and a supplier. A professional partner works with you to find a solution that helps both our businesses succeed. Let's explore the options.

What payment methods are common for Sucralose?

Confused by terms like T/T, L/C, D/P? Choosing the wrong payment method can expose you to unnecessary risk, high bank fees, or major delays.

The most common payment methods are Telegraphic Transfer (T/T), often as a deposit plus balance, and a Letter of Credit (L/C) for larger orders. Documents Against Payment (D/P) is sometimes used between trusted partners. The choice depends on trust and transaction value.

Choosing the right payment method is about balancing speed, cost, and security. Telegraphic Transfer (T/T)1 is a direct wire transfer. It is fast, cheap, and the most common method, usually structured as a 30% deposit with a 70% balance payment. A Letter of Credit (L/C)2 is a bank guarantee. It offers the highest security for both buyer and seller but is slow, complex, and has high fees, making it suitable only for very large orders or new relationships. Documents Against Payment (D/P) is used between long-term, trusted partners, as it carries more risk for the supplier.

Payment Method Comparison:

| Method | Speed | Cost | Security (for Buyer) | Security (for Supplier) |

|---|---|---|---|---|

| Telegraphic Transfer (T/T) | Fast | Low | Fair | Good (with deposit) |

| Letter of Credit (L/C) | Slow | High | Excellent | Excellent |

| Documents Against Payment (D/P) | Fair | Low | Good | Low |

Why are flexible terms useful for Sucralose buyers?

Is your cash flow tight? A supplier demanding 100% upfront payment can be impossible to work with, forcing you to miss out on valuable market opportunities.

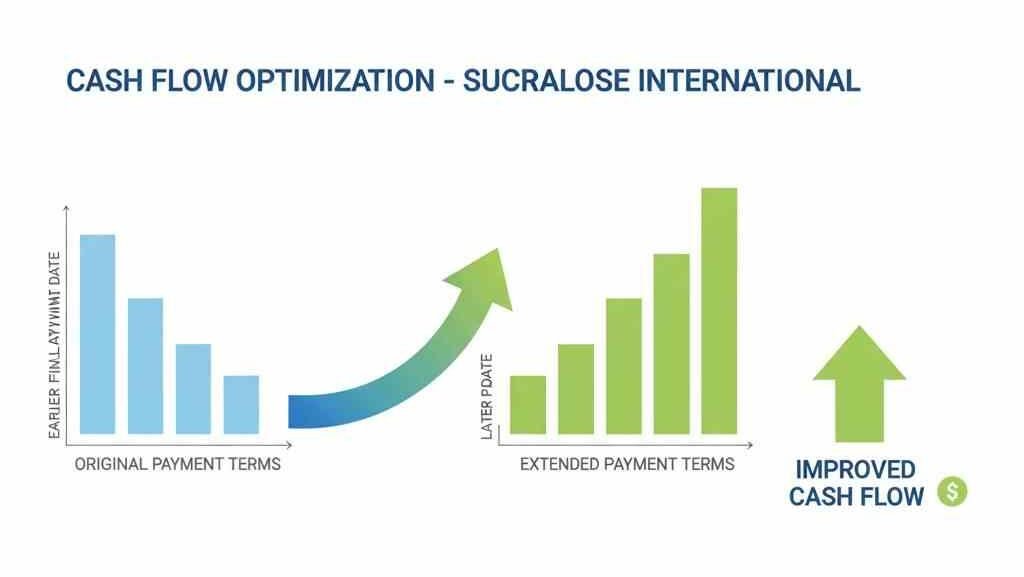

Flexible payment terms are useful because they significantly improve a buyer's cash flow. Terms like paying the balance after shipment allow the buyer to manage their capital more effectively, making it easier to place larger or more frequent orders.

Flexibility in payment terms3 is a sign of a true partnership. A term like "30% deposit, 70% balance against B/L copy" has a huge impact on a buyer's cash flow4. It means you only pay 30% upfront, and the large balance payment is not due until after the goods are produced and shipped. This frees up your capital to run and grow your business. This kind of flexibility is not given on the first order; it is earned through a history of reliable, on-time payments, building a foundation of trust.

Payment Terms and Business Impact:

| Payment Term | Cash Flow Impact for Buyer | Trust Level Required |

|---|---|---|

| 100% T/T in Advance | Very Poor | Very Low (Risky for Buyer) |

| 30% Deposit, 70% Before Shipment | Poor | Low (Typical Start) |

| 30% Deposit, 70% Against B/L Copy | Good | Good (Trusted Partner) |

| D/P (Documents Against Payment) | Excellent | Very High (Long-term) |

How do letters of credit support Sucralose transactions?

Worried about sending a huge payment to a new supplier thousands of miles away? What if you pay them, and they never ship your Sucralose?

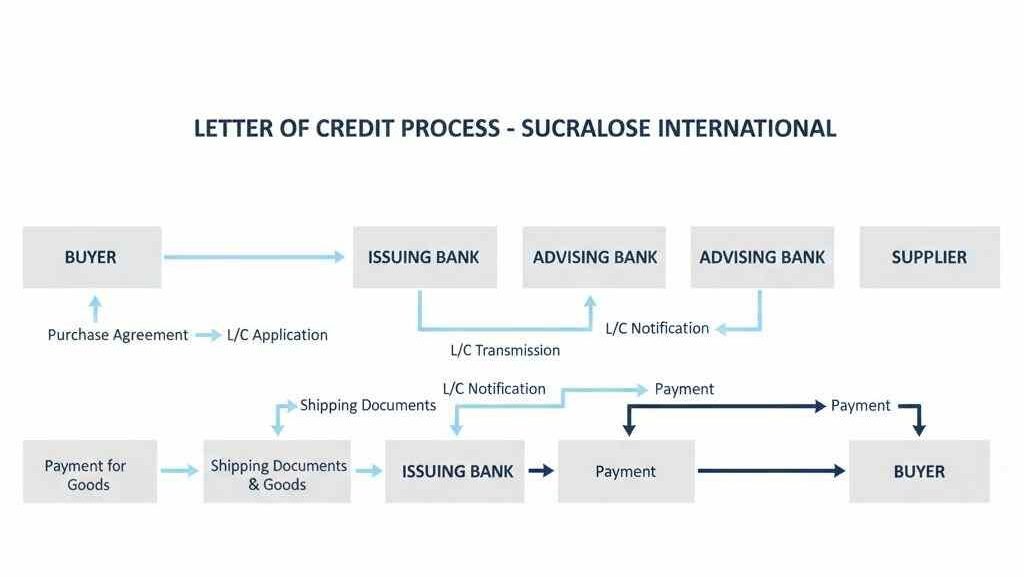

A Letter of Credit (L/C) acts as a secure intermediary. The buyer's bank guarantees payment to the supplier, but only after the supplier provides perfect shipping documents that prove the goods have been shipped as agreed. It eliminates payment risk for both parties.

An L/C is the safest way to conduct international trade. For the buyer, it guarantees that your bank will not release the payment until I provide proof of shipment (the Bill of Lading). No shipment, no payment. For the supplier, it is an irrevocable guarantee from your bank that I will be paid if I follow the rules perfectly. Despite this security, L/Cs are not used for every order because they are slow, complex, and have very high bank fees5. They are best reserved for very large transactions or brand-new partnerships.

Pros and Cons of Using a Letter of Credit (L/C):

| Pros | Cons |

|---|---|

| Maximum security for both buyer and supplier. | Complex and has very strict rules. |

| Eliminates risk of non-payment or non-shipment. | High bank fees. |

| Can include quality requirements. | Slow process from start to finish. |

How do deposits reduce risks in Sucralose orders?

From my perspective as a supplier, what happens if I start producing 20 tons of Sucralose for a new buyer, and they suddenly cancel the order?

A deposit, typically 20-30%, acts as a crucial commitment from the buyer. It reduces the supplier's risk by covering initial production costs and ensuring the buyer is serious. This shared risk allows the supplier to offer more flexible balance payment terms.

A deposit is a fundamental signal of a serious business commitment. When a buyer places an order, I take on real financial risk by committing to production. The deposit protects me by demonstrating the buyer's commitment and covering the initial costs of raw materials. This sharing of risk is what allows me to be more flexible on the final, larger balance payment. Without a deposit, I could not offer the flexible terms that my best partners value so highly.

The Deposit: A Two-Sided View

| Perspective | With 30% Deposit | Without Deposit |

|---|---|---|

| Buyer | Demonstrates seriousness, unlocks flexible terms. | Keeps cash, but may face stricter 100% advance terms. |

| Supplier | Risk is reduced, production can start confidently. | High risk, may refuse the order or demand 100% advance. |

How can suppliers help new buyers purchase Sucralose?

Are you new to importing food additives? The process can seem complex and intimidating, from quality control and logistics to payment terms.

A good supplier acts as a guide for new buyers. We help by offering lower Minimum Order Quantities (MOQs), providing clear step-by-step guidance on the import process, and starting with secure, transparent payment terms that build trust.

My goal is to build long-term relationships, which means helping new buyers succeed. I do this in three ways. First, I offer a low Minimum Order Quantity (MOQ)6, so you can start with a smaller investment. Second, I act as a consultant, providing clear guidance on the entire import process from documents to shipping. Third, we start with simple, secure payment terms like 30/70 T/T. This straightforward process builds the trust that is the foundation of a great partnership.

Supplier Support for New Buyers:

| Area of Support | Action Taken by Supplier | Benefit for the New Buyer |

|---|---|---|

| Financial Risk | Offer a low Minimum Order Quantity (MOQ). | Can start their business with a much smaller investment. |

| Process Knowledge | Provide step-by-step guidance on logistics/docs. | Reduces stress and avoids common mistakes. |

| Payment Terms | Start with simple, secure T/T terms (30/70). | Easy to understand and builds trust for the future. |

Conclusion

Payment terms are more than transactions. They are the foundation of a strong, flexible, and trusting partnership that enables long-term business success for both parties.

-

Explore this link to understand why T/T is favored for its speed and cost-effectiveness in transactions. ↩

-

Learn about L/C to see how it provides security in transactions, especially for large orders. ↩

-

Exploring flexible payment terms can help you optimize your cash management and strengthen supplier relationships. ↩

-

Understanding cash flow is crucial for managing your business finances effectively and ensuring growth. ↩

-

This resource will explain the reasons behind high bank fees, helping you make informed decisions about your financial transactions. ↩

-

Understanding the significance of low MOQs can help you make informed purchasing decisions and minimize risk. ↩