Struggling with budget-breaking Vitamin A price spikes? Worried about how this volatility impacts your bottom line? You are not alone in this high-stakes market.

Vitamin A prices directly affect food companies by increasing production costs and squeezing profit margins. The market's extreme volatility forces businesses to adopt strategic purchasing and risk management to maintain profitability and supply continuity.

I help clients navigate the challenging Vitamin A market. Its price volatility is extreme and can impact the profitability of entire divisions. Understanding what drives these prices is the first step to controlling your costs and protecting your business.

What causes Vitamin A price changes?

Do Vitamin A prices seem to move randomly? Understanding the real causes is the first step to gaining control and protecting your budget.

Vitamin A price changes are caused by two main factors: sudden supply shocks from shutdowns at one of the few global factories, and fluctuations in the cost of key raw materials like citral, which are tied to the petrochemical market.

Vitamin A prices spike for two main reasons. First, supply shocks1: the global supply is highly concentrated, so an accident or shutdown at just one major factory (like the BASF fire in 2017) can cause a severe global shortage and massive price increases. Second, raw material costs2: the key ingredients are derived from the petrochemical industry, so the underlying cost of crude oil sets the baseline price for Vitamin A.

Price Driver Comparison:

| Price Driver | Cause | Speed of Price Impact | Magnitude of Price Impact |

|---|---|---|---|

| Supply Shocks | Factory accident, shutdown, force majeure. | Sudden, within days or weeks. | Extreme (e.g., 100-500% increase). |

| Raw Material Costs | Gradual changes in crude oil prices. | Slower, over several months. | Moderate (e.g., 10-30% increase). |

How does the petrochemical market affect Vitamin A cost?

Think the price of oil doesn't affect your food ingredients? For Vitamin A, the link is direct and powerful. Ignoring it means missing the biggest early warning sign.

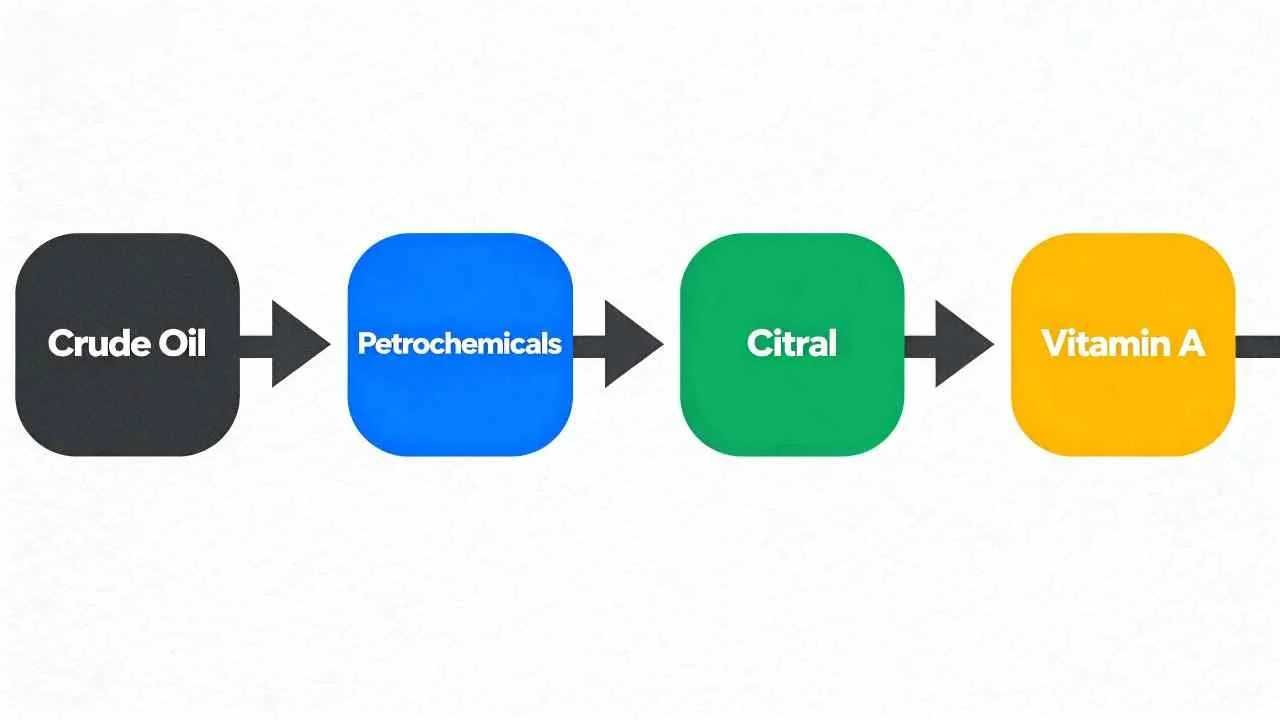

The petrochemical market directly affects Vitamin A cost because its primary raw material, citral, is synthesized from petroleum derivatives. When crude oil prices rise, the cost of producing Vitamin A increases, and this cost is passed on to buyers.

The production chain for Vitamin A begins with crude oil. Key raw materials are petrochemical derivatives. This creates a direct link: when global oil prices rise, the input costs for Vitamin A factories increase. To maintain their own profitability, factories must pass this cost increase on to buyers. Therefore, a sustained period of high crude oil prices3 will always lead to a higher baseline price for Vitamin A.

Hypothetical Cost Impact of a Petrochemical Price Rise:

| Cost Component (per kg Vitamin A) | Normal Market Scenario | High Oil Price Scenario | Comments |

|---|---|---|---|

| Petrochemical Raw Materials | $15 | $22 | The cost of key precursors rises with the price of oil. |

| Final Selling Price | $30 | $39 | The final price increases significantly due to input costs. |

How does global demand change Vitamin A prices?

Is your small order affecting the global price? The combined demand from massive industries creates a powerful force that sets the market's foundation.

Global demand, primarily from the massive animal feed industry, creates a strong and stable price floor. While less volatile than supply, shifts in feed formulation trends or economic growth can cause gradual price increases over time.

The vast majority (~85%) of Vitamin A is used in animal feed. This creates a huge, constant baseline of global demand. This demand is also "inelastic"—because the vitamin is a tiny part of the final cost of feed or food, large companies continue to buy even when the price rises. This inelastic demand4 creates a strong "price floor" that prevents prices from falling too far and provides long-term upward pressure on the market.

Global Demand for Vitamin A:

| Demand Sector | Market Share (Approx.) | Key Drivers | Price Sensitivity |

|---|---|---|---|

| Animal Nutrition (Feed) | ~85% | Global meat and dairy consumption, feed formulation. | Very Low |

| Human Nutrition (Food) | ~15% | Food fortification programs, dietary supplements. | Low to Medium |

How can buyers predict Vitamin A prices?

Do you feel like you are always reacting to price news? Predicting prices is not magic; it is about watching the right signals.

Buyers can predict Vitamin A prices by monitoring three key indicators: the price of crude oil as a long-term signal, news about factory shutdowns for short-term shocks, and official export data from China to confirm supply flows.

You can predict the market's direction by monitoring three key signals. First, watch crude oil prices; a sustained rise is an early warning of future price increases. Second, monitor factory news for announcements of shutdowns or force majeure, which signal immediate price spikes. Third, use trade data5 from China to confirm if a supply shock is actually impacting global flows.

Buyer's Forecasting Toolkit:

| Indicator | Information Source | Signal Interpretation |

|---|---|---|

| Crude Oil Prices | Financial news (e.g., Brent, WTI) | A sustained rise signals a future baseline price increase. |

| Factory News | Industry news services, supplier updates | An accident or shutdown signals an immediate price spike. |

| Trade Data | Customs statistics, trade analysis services | A drop in exports confirms a supply shock is occurring. |

How can businesses control Vitamin A costs?

Are price spikes wrecking your budget? You do not have to be a victim of the market. There are proven strategies to regain control.

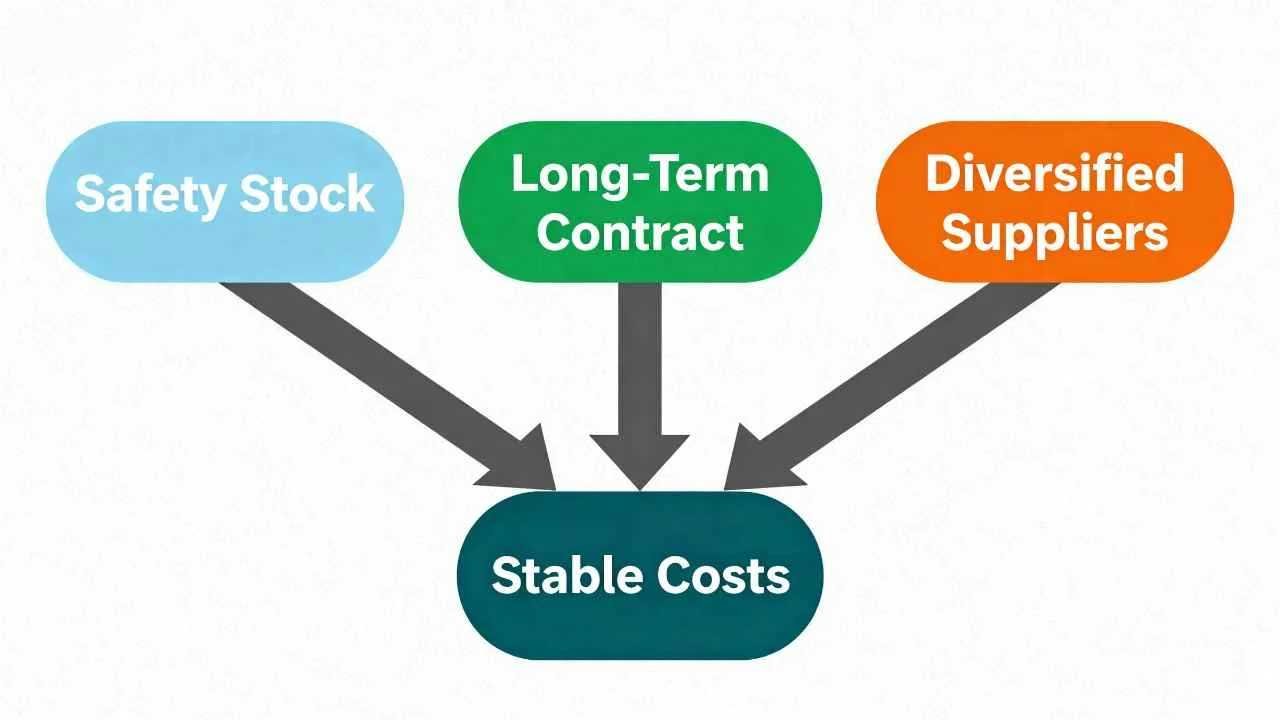

Businesses can control Vitamin A costs by adopting strategic procurement methods. These include signing long-term contracts to lock in prices, maintaining a strategic safety stock, and building relationships with multiple reliable suppliers.

In a volatile market, you must be strategic. First, maintain a safety stock of 2-3 months' inventory; this is your insurance policy against sudden price spikes. Second, for predictable needs, sign a long-term contract to lock in your price for 6-12 months, which provides complete budget certainty. Third, ensure you are qualified with at least two diversified suppliers to provide a backup source and improve your negotiating position.

Procurement Strategy Comparison:

| Strategy | Price Volatility Exposure | Supply Security Risk | Budget Predictability |

|---|---|---|---|

| Just-in-Time (Spot Buying) | Very High | Very High | Very Low |

| Long-Term Contract | Very Low | Very Low | Very High |

Conclusion

Vitamin A price volatility is a major business risk. Strategic forecasting and smart procurement are essential to control costs, ensure supply, and protect your profitability.

-

Understanding supply shocks can help you grasp their impact on market prices and economic stability. ↩

-

Exploring raw material costs will provide insights into pricing strategies and market dynamics. ↩

-

Exploring the impact of crude oil prices on the economy provides insights into market dynamics and potential investment opportunities. ↩

-

Exploring inelastic demand will help you grasp how certain products maintain stable prices despite market fluctuations. ↩

-

Exploring trade data insights can reveal critical information about supply shocks and their implications for the global economy. ↩