Navigating the dextrose market? Worried about price changes and supply? Let's quickly break down the most important trends for buyers right now.

Current dextrose market trends show rising demand in Africa, supply shifts from EU green laws, ongoing price competition from China, and significant price volatility in 2024 driven by raw material and shipping costs.

I see these trends every day at FINETECH. My clients need to understand these market forces to make smart purchasing decisions and avoid surprises. Let's get straight to the key points.

Why is demand for Dextrose Monohydrate rising in Africa?

Seeing more orders going to Africa? Wondering what's behind this growth? Let's look at the factors driving this demand surge.

Dextrose demand in Africa is growing due to population increases, urbanization, a booming food and beverage industry, and more use in local pharmaceutical and animal feed production.

We've observed a clear increase in orders from Africa, driven by strong and lasting structural changes.

Key Drivers:

- Food & Beverage Growth1: A bigger, more urban population wants more processed foods like sweets, baked goods, and beverages. Dextrose is a key, cost-effective ingredient in these products.

- Other Industries: Use is also growing in locally produced pharmaceuticals (as an excipient) and in animal feed (as an energy source) to support expanding livestock farming.

- Demographics2: A large, young population with rising incomes is fueling this overall consumption boom.

This long-term trend makes Africa a key growth market for ingredients like dextrose.

How do EU green laws affect the supply of Dextrose Monohydrate?

Worried about EU regulations on your supply? How will green laws change things? Let's clarify the impact of these new rules.

EU green laws, especially the Carbon Border Adjustment Mechanism (CBAM), add compliance costs and paperwork for producers. This can lead to higher prices and potentially tighter supply.

The EU's environmental goals are changing global supply chains. Policies like CBAM3 act as a carbon tax on imported goods.

What this means for buyers:

- Higher Costs: Producers inside and outside the EU face higher costs related to their carbon emissions. These costs will likely be passed on to you.

- More Paperwork: Suppliers now need to provide detailed data on the carbon footprint of their products, which adds administrative complexity.

- Supply Shifts: Some producers may struggle to comply and exit the EU market. Suppliers with strong sustainability credentials4 and data, like FINETECH, become more valuable partners.

The market is becoming more complex, rewarding suppliers who can guarantee quality and compliance.

Is China still the cheapest source for Dextrose Monohydrate?

Always buy from China for the best price? Is that still the smart move? Let's check if China is still the most cost-effective source.

China often remains the most competitive source due to its huge production scale. But rising labor/environmental costs and high shipping rates are closing the price gap with other regions.

While China has major advantages in production scale, the total cost picture is changing.

Factors to consider:

- China's Advantages5: Massive factories provide economies of scale that are hard to beat.

- Rising Costs in China: Labor wages and stricter environmental regulations are increasing production costs.

- Global Factors: High ocean freight rates can erase China's price advantage. Other regions like the US (huge corn supply), Europe, and Southeast Asia (lower labor costs, proximity) are also competitive.

The Verdict: China is often still the cheapest, but it's no longer a guarantee. Buyers must compare the total landed cost from different origins.

Why are Dextrose Monohydrate prices changing in 2024?

Seeing dextrose prices move up and down? What's causing the instability this year? Let's break down the main reasons for price changes in 2024.

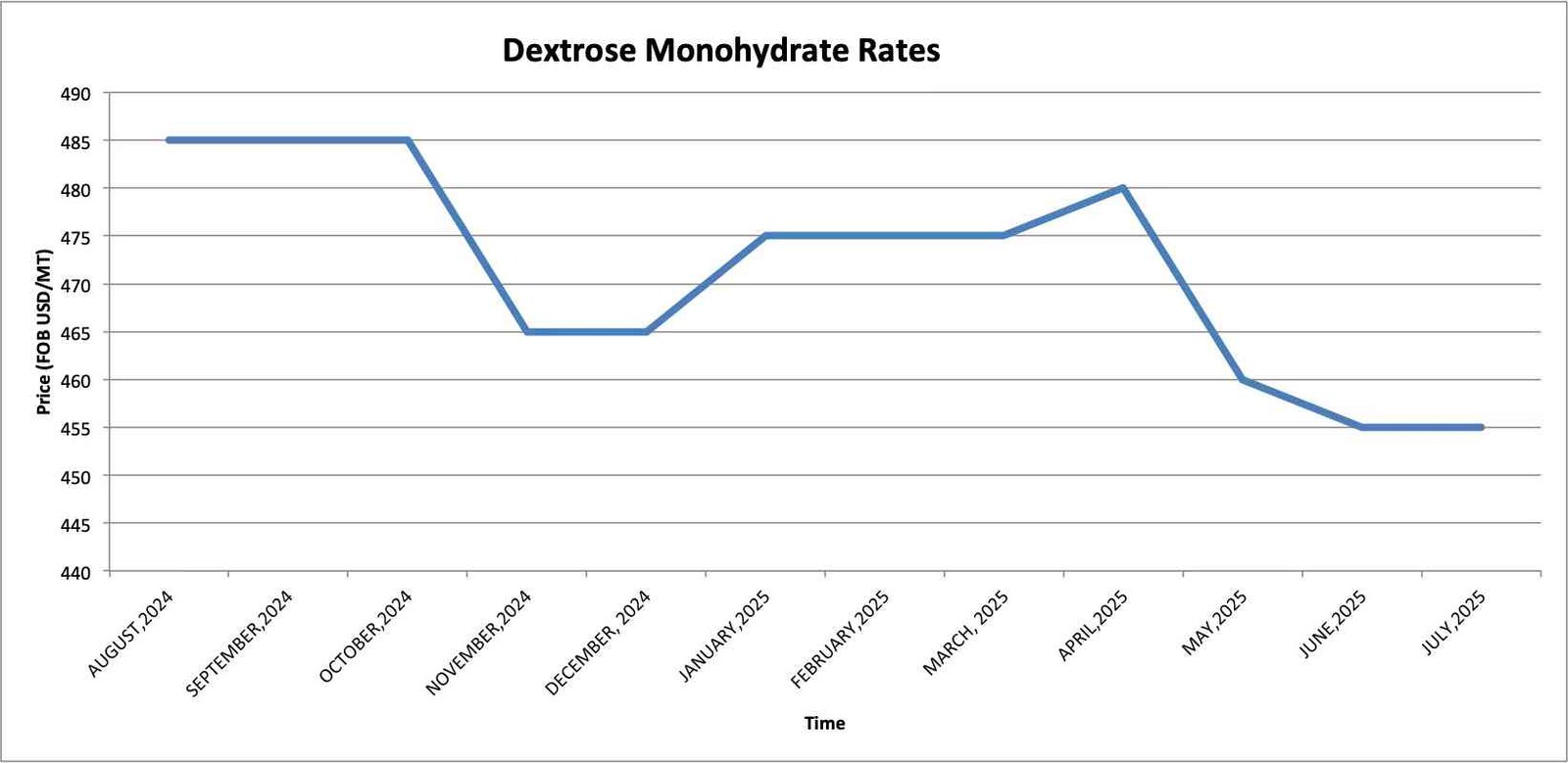

Dextrose prices in 2024 are volatile because of fluctuating corn and energy costs, unpredictable global shipping rates (e.g., Red Sea issues), and shifting regional supply and demand.

Price volatility is a major headache. For 2024, the key drivers are:

- Raw Material (Corn): Corn prices are unstable due to weather and geopolitics. This is the biggest factor.

- Energy Prices: Dextrose production is energy-intensive, so higher energy costs mean higher dextrose prices.

- Shipping Rates: Disruptions in major shipping lanes like the Red Sea have increased costs and transit times.

- Currency Fluctuations: A strong US dollar can make dextrose more expensive in other local currencies.

Navigating this requires constant market monitoring, which is a service we provide to our clients at FINETECH.

Can you lock in a future price for Dextrose Monohydrate?

Tired of price swings? Want to secure a stable price for future orders? Let's see if locking in a price is an option.

Yes, you can often lock in a future price for dextrose through forward contracts or blanket orders with a supplier, especially for large, consistent volumes.

Fixing prices is possible and a great strategy for some buyers. It's usually done through a forward contract for a set volume over a period like 6-12 months.

- Pros: You get budget certainty and are protected if market prices spike. It also helps secure your supply.

- Cons: You don't benefit if market prices fall. You are committed to taking the full volume.

This strategy is best for large-volume buyers with stable, predictable demand who value stability over the chance of catching market lows.

Conclusion

Dextrose market trends show rising African demand and EU green law impacts. Prices are volatile. Proactive sourcing and strategic price-locking are key to navigating today's market successfully.

-

Explore this link to understand the booming food and beverage market in Africa and its implications for businesses. ↩

-

This resource will provide insights into how Africa's demographics are shaping economic opportunities and consumer behavior. ↩

-

Understanding CBAM is crucial for navigating the evolving landscape of international trade and compliance. ↩

-

Exploring sustainability credentials can help you identify reliable partners and enhance your supply chain's resilience. ↩

-

Exploring China's production advantages can provide insights into competitive strategies and market dynamics. ↩