Worried about sending money overseas for an order? Afraid a supplier won't ship after you pay? Let's explore the safest ways to handle payments in international trade.

The safest payment options are a Letter of Credit (L/C) for maximum security, or a partial Telegraphic Transfer (T/T) with the balance paid against shipping documents. The best choice depends on the transaction value and your level of trust with the supplier.

At FINETECH, navigating payment methods is a critical part of my job. For a client, managing financial risk is as important as getting a competitive price. A secure payment process is the foundation of a successful and long-term business relationship. Let's look at the best options.

What flexible payment terms can buyers negotiate for Tomato Paste orders?

Does your supplier demand 100% payment upfront? Looking for better terms that protect your cash flow? Let's discuss the flexible options you can negotiate.

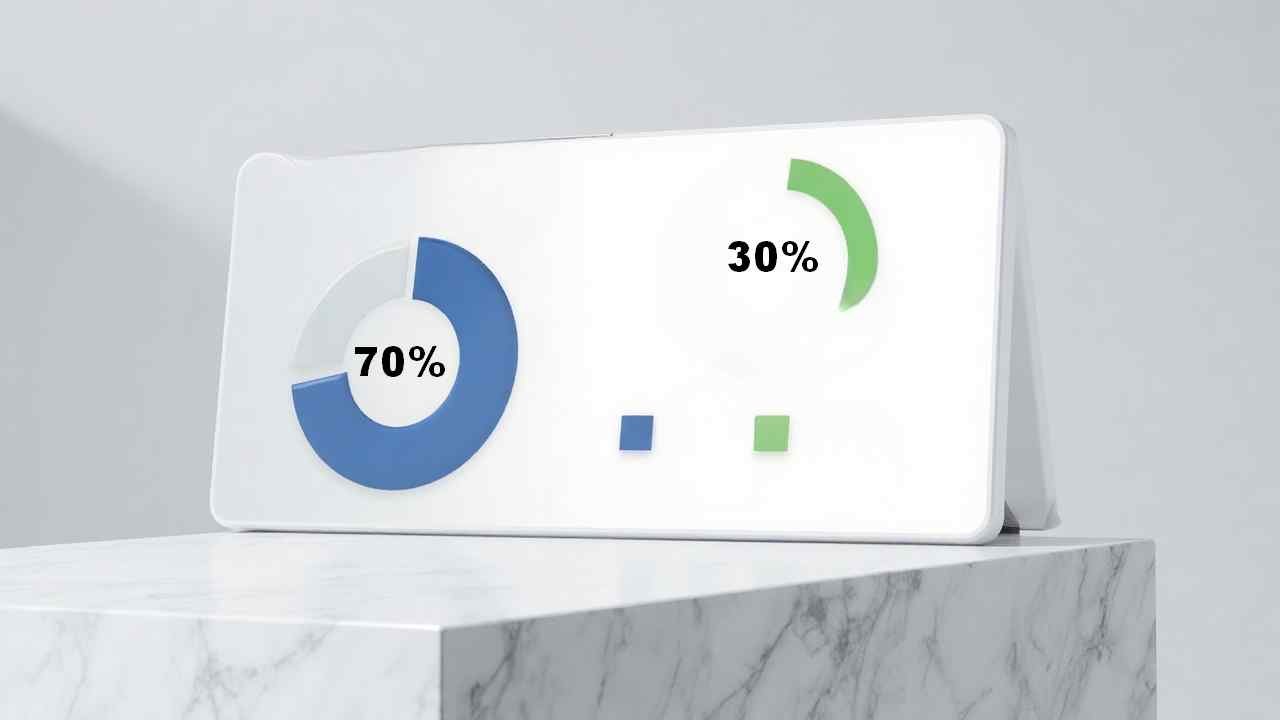

Buyers can negotiate flexible terms like a 10-30% advance deposit with the 70-90% balance paid only after the goods are shipped and proven by a copy of the Bill of Lading (B/L).

A fair payment term splits the risk. The most common and balanced structure is a partial Telegraphic Transfer (T/T). The buyer pays a small deposit (10-30%)1 to start the order, which shows a serious commitment. The buyer then pays the balance (70-90%)2 only after the supplier provides a copy of the Bill of Lading (B/L) as proof of shipment. This is a fair compromise: the buyer's risk is limited to the deposit, and the supplier retains control until the final payment is arranged.

Payment Term Risk Analysis:

| Payment Term | Buyer's Risk | Supplier's Risk | Best For |

|---|---|---|---|

| 100% T/T in Advance | Very High | Very Low | Small sample orders or extremely high-trust relationships. |

| 30% T/T Deposit, 70% vs. B/L Copy | Low | Low | The industry standard for most bulk orders. |

| 100% L/C at Sight | Very Low | Very Low | Very large or high-risk transactions. |

How does a Letter of Credit (L/C) secure transactions for both buyer and supplier of Tomato Paste?

Dealing with a new supplier or a very large order? A Letter of Credit (L/C) is the ultimate solution for security.

A Letter of Credit (L/C) is a guarantee from the buyer's bank to pay the supplier, but only once the supplier presents a perfect set of pre-agreed shipping documents. It secures the deal by replacing the buyer's credit risk with the bank's.

An L/C acts as a neutral referee. For the buyer3, it guarantees you won't pay until you have documentary proof that the correct goods have been shipped. For the supplier, it guarantees they will get paid by the bank as long as they provide the correct documents. While an L/C is very secure, it is also slower, more complex, and more expensive than a T/T due to the high bank fees and strict paperwork requirements.

L/C vs. Balanced T/T:

| Feature | Letter of Credit (L/C) | Balanced T/T (e.g., 30/70) |

|---|---|---|

| Security | Very High. Backed by banks. | High. Risk is shared, payment linked to proof of shipment. |

| Cost | High (bank fees for both parties). | Low (standard bank wire transfer fees). |

| Speed | Slower (requires bank processing time). | Faster (direct transfer between accounts). |

| Best For | Very large orders, or the first transaction with a new supplier. | Most standard transactions with trusted partners. |

When is an advance payment (T/T) suitable for Tomato Paste purchases?

Is a 100% advance payment ever a good idea? Worried that it might be a scam? Let's discuss when this high-risk method is appropriate.

A full advance payment (100% T/T) is only suitable for very small orders, like samples, or in cases where you have a very long-standing, high-trust relationship with your supplier. For most bulk orders, it carries a high risk for the buyer.

Paying 100% upfront is very risky for a buyer, as you have no leverage if something goes wrong. However, it is the standard and accepted method for sample orders4 where the value is very low (a few hundred dollars). It may also be used between partners with a long history of trust5 as a way to simplify paperwork, but this is an exception based on a proven track record. For any standard bulk order, you should insist on a partial payment structure.

Risk Assessment for T/T Payments:

| T/T Structure | Buyer Risk Level | Recommended Use Case |

|---|---|---|

| 100% Advance | Very High. Buyer has no leverage after payment. | Samples, or with a very long-term, highly trusted partner. |

| 30% Advance, 70% Balance | Low. Majority of funds held until proof of shipment. | The standard for most bulk international trade transactions. |

Can trade credit insurance reduce financial risks in Tomato Paste deals?

Want more flexible payment terms? Wondering if there's a way for your supplier to offer credit safely? Let's talk about credit insurance.

Yes, trade credit insurance is a policy that the supplier buys to protect themselves if a buyer fails to pay. This reduces the supplier's risk, which allows them to confidently offer more flexible "buy now, pay later" terms to the buyer.

This is a tool for the supplier, but it benefits the buyer. When a supplier is insured against non-payment, they are much more willing to offer you better payment terms that help your cash flow. Instead of a T/T deposit, they might offer Documents against Payment (D/P), where you pay when the documents arrive at your bank, or even Documents against Acceptance (D/A), which is a form of 30 or 60-day credit. If a supplier has this insurance, it's a good sign they are a professional exporter.

Comparing Risk Mitigation Tools:

| Tool | Who is Primarily Protected? | How it Works | Best For... |

|---|---|---|---|

| Letter of Credit (L/C) | Both Buyer and Supplier | Banks act as intermediaries, guaranteeing the transaction. | High-value orders or new relationships. |

| Trade Credit Insurance | Supplier (Exporter) | Insures the supplier against the buyer's non-payment. | Enabling suppliers to offer credit terms to trusted buyers. |

Which payment method is most recommended for bulk Tomato Paste orders?

After looking at all the options, what is the best, most practical choice for a standard order? Let's get to the final recommendation.

For most bulk tomato paste orders, a partial T/T (20-30% deposit, balance against B/L copy) is most recommended. For very large or higher-risk transactions, a confirmed, irrevocable Letter of Credit (L/C) is the safest choice.

The balanced partial T/T is the gold standard for the industry. It's the perfect combination of shared risk, speed, simplicity, and low cost. This should be your default method for most transactions. Use a Letter of Credit (L/C) only when the stakes are higher: for a very large, high-value order, or for your very first transaction with a new, unvetted supplier. The key is to match the tool to the level of risk.

Decision Matrix for Payment Methods:

| Your Situation | Recommended Method | Why It's Recommended |

|---|---|---|

| Standard order with a trusted partner | T/T (30% / 70%) | The most efficient, fair, and cost-effective method. The industry standard. |

| Very large (high-value) order | Letter of Credit (L/C) | The high value of the transaction justifies the extra security and cost. |

| Small sample order | T/T (100% Advance) | The low value makes this the only practical and cost-effective option. |

Conclusion

Choosing the right payment method balances risk, cost, and trust. For most tomato paste deals, a split T/T is ideal. For large, high-risk orders, an L/C provides maximum security.

-

Understanding the concept of a deposit is crucial for managing financial commitments in transactions. ↩

-

Exploring the meaning of balance in payment terms helps clarify the financial obligations in a transaction. ↩

-

Understanding the buyer's role in a letter of credit can help you navigate international trade more effectively. ↩

-

Understanding sample orders can help you navigate low-value purchases and mitigate risks effectively. ↩

-

Exploring the significance of trust in business can enhance your negotiation strategies and partnership decisions. ↩