Is your shipment stuck at customs? Worried about surprise fees and rejected products? Navigating import rules can be complex, but getting them wrong is a costly mistake.

Buyers must follow key import rules for vanillin, including using the correct customs HS code, meeting the destination country's food safety standards, ensuring strict labeling compliance, and preparing for import duties. Providing the right certifications is crucial for a smooth process.

I spend much of my time preparing documentation for clients. A detail-oriented buyer knows that even a perfect product is useless if it cannot clear customs. Paperwork is the passport that allows your product to enter the country. Let’s walk through the essential rules to ensure your shipments arrive without issues.

How do customs regulations affect Vanillin shipments?

Ever had a shipment delayed because of a simple paperwork error? One wrong turn in the customs maze can stop your shipment in its tracks.

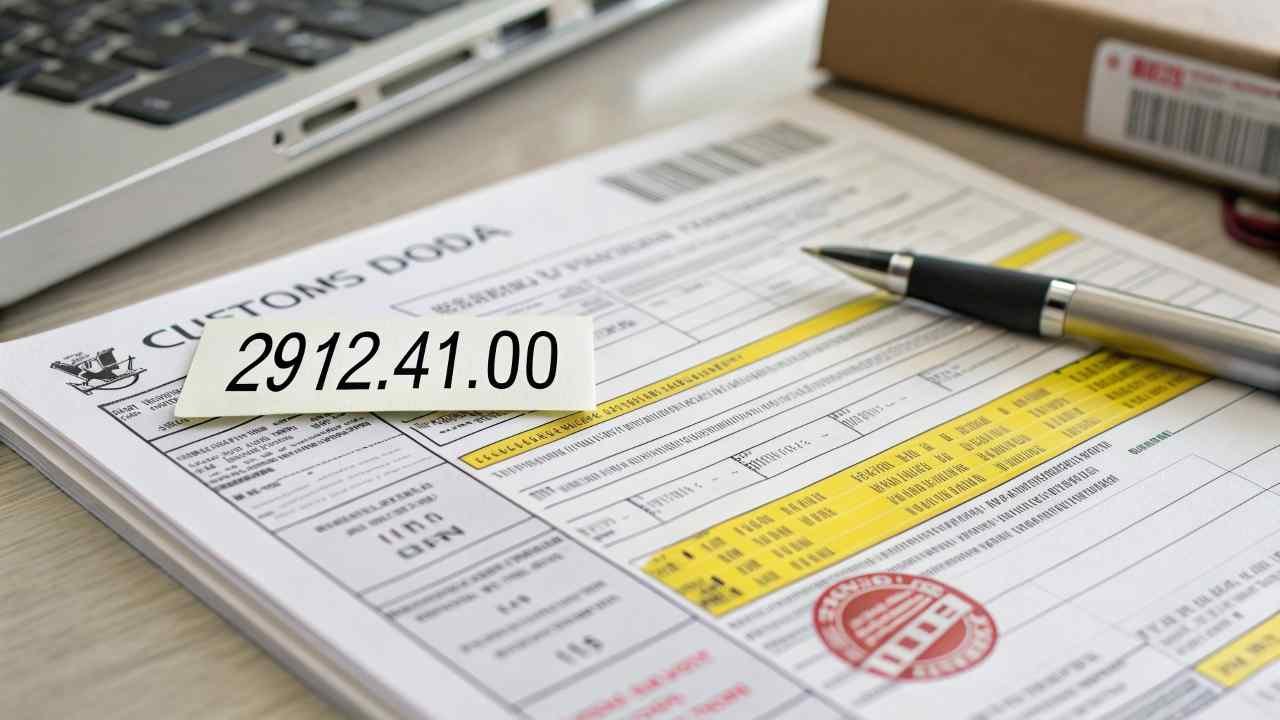

Customs regulations directly affect shipments by requiring precise documentation, including the correct Harmonized System (HS) code. Errors in the commercial invoice or packing list can lead to delays, fines, and even seizure of the goods.

The most critical detail for customs is the Harmonized System (HS) code1; for vanillin, it is 2912.41.00. This code must be correct on all documents. Your key paperwork—the commercial invoice and packing list—must be accurate and match each other perfectly, detailing the product, value, and weight. Any error raises a red flag with customs officials, leading to costly delays.

Essential Customs Documents:

| Document | Purpose | Common Mistakes to Avoid |

|---|---|---|

| Commercial Invoice | Declares the value and details of the goods. | Incorrect price, vague product description, wrong HS code. |

| Packing List | Details the physical contents of the shipment. | Mismatch with the commercial invoice, incorrect weights. |

| Bill of Lading (B/L) | The contract with the shipping company. | Incorrect consignee details, wrong port of discharge. |

What food safety standards are required for Vanillin trade?

Are you sure the vanillin you are buying is legal in your country? Importing a non-compliant product can lead to a total loss of your shipment.

Vanillin must comply with international food safety standards like the Food Chemicals Codex (FCC). Crucially, it must also meet the specific regulations of the importing region, such as the FDA's GRAS status in the USA or EFSA's approved additive rules in the EU.

Your vanillin must meet both global and local standards. The global benchmark is the Food Chemicals Codex (FCC)2, which guarantees purity and is stated on the Certificate of Analysis (COA). More importantly, the product must comply with your region's specific laws, such as FDA's GRAS3 (Generally Recognized As Safe) status in the USA or EFSA rules in the European Union. Your supplier must provide documentation proving compliance for your specific destination market.

Key Food Safety Regulations Compared:

| Regulation Body | Region | Key Requirement for Vanillin | Proof of Compliance |

|---|---|---|---|

| FCC (Food Chemicals Codex) | International | Meets global purity and identity standards. | Statement of compliance on the Certificate of Analysis (COA). |

| FDA (Food and Drug Admin.) | USA | Must be GRAS (Generally Recognized As Safe). | Supplier's GRAS declaration, GMP certification. |

| EFSA (European Food Safety) | European Union | Must be an approved flavoring, produced according to EU law. | Supplier declaration, compliance with EU contaminant limits. |

Are labeling requirements strict for Vanillin exports?

Do you think the label on the drum is just for information? A small mistake in labeling can be a major compliance failure.

Yes, labeling requirements are extremely strict. Every package must clearly display the product name, net weight, batch number, production/expiry dates, and country of origin. Failure to comply can result in customs holds.

The label on an export package is a legal document. It must clearly and accurately show all required information: product name, net weight, batch number, manufacturing/expiry dates, and country of origin. The batch number is especially critical, as it is essential for food safety traceability. A missing or incorrect detail is one of the most common reasons for a shipment to be delayed for inspection by customs.

Export Label Compliance Checklist:

| Label Element | Is it present? | Why it's critical |

|---|---|---|

| Product Name | Yes / No | Tells customs exactly what is in the package. |

| Net Weight | Yes / No | Used to verify the shipment and calculate duties. |

| Batch Number | Yes / No | Essential for food safety traceability. |

| Production/Expiry Date | Yes / No | Confirms the product is within its shelf life. |

How do import duties influence Vanillin costs?

You have negotiated a great price with your supplier. But have you budgeted for import duties? This "hidden" tax can significantly increase your final cost.

Import duties are taxes charged by the destination country's government. Calculated based on the vanillin's value and HS code, they are a direct cost to the importer and can significantly impact the final landed cost.

The price you pay your supplier is not your final cost. You must also pay import duties4 to your government. This tax is typically a percentage of the shipment's total value (CIF value) and can add 5-20% or more to your total cost. It is crucial to know your country's duty rate for the vanillin HS code (2912.41.00) and include it in your budget. Also, check for Free Trade Agreements (FTAs)5, which may reduce this duty to zero if you have the correct Certificate of Origin.

Landed Cost Example (on a $15,000 CIF Value):

| Country | Duty Rate for HS 2912.41.00 (Example) | Import Duty Payable | Final Landed Cost (before local fees) |

|---|---|---|---|

| Country A (No FTA) | 10% | $1,500 | $16,500 |

| Country B (FTA) | 0% | $0 | $15,000 |

Which certifications help clear Vanillin customs faster?

Is your shipment always chosen for extra inspection? Waiting for lab results can take weeks. The right certifications act like a fast pass through customs.

Key certifications like ISO 22000, HACCP, Halal, and Kosher greatly speed up customs clearance. These globally recognized standards prove the product comes from a reputable facility, reducing the likelihood of time-consuming inspections and testing.

Certifications build trust with customs officials and show your shipment is low-risk. Food safety certifications like ISO 22000 and HACCP prove the factory follows high-quality management and production standards. This reduces the chance of random inspections. For specific markets, other certifications are mandatory. Halal is essential for most Muslim countries, while Kosher is required for others. Sourcing from a fully certified factory is the safest and most efficient strategy.

Key Certifications and Their Importance:

| Certification | What it Proves | Benefit for Customs Clearance |

|---|---|---|

| ISO 22000/HACCP | The factory has a robust Food Safety System. | Builds trust, reduces risk profile of the shipment. |

| Halal | The product complies with Islamic dietary law. | Often mandatory for import into Muslim countries. |

| Kosher | The product complies with Jewish dietary law. | Required for specific markets, seen as a high-quality mark. |

Conclusion

Successfully importing vanillin depends on getting the details right. Correct documentation, certifications, and a clear understanding of the rules are essential for a smooth and cost-effective process.

-

Understanding the HS code is crucial for smooth customs clearance and avoiding delays. ↩

-

Understanding the FCC is crucial for ensuring product purity and compliance in the food industry. ↩

-

Exploring FDA's GRAS status helps you grasp safety standards that can impact product approval and marketability. ↩

-

Understanding import duties is essential for budgeting and cost management in international trade. ↩

-

Exploring FTAs can reveal opportunities to reduce costs significantly through duty exemptions. ↩