Worried about sending a large payment overseas? Hesitant to tie up your cash flow on a deposit? Choosing the right payment term is a major business decision.

The most common payment options for Vitamin A are Telegraphic Transfer (T/T), often a 30% deposit with a 70% balance, and a Letter of Credit (L/C) for high-value security. More flexible terms are often available for established, long-term partners.

Payment terms are about risk management and trust. A strategic buyer needs terms that secure the transaction and work with their company's cash flow. Finding the right balance is the key to building a strong and lasting partnership. Let's look at the options.

Why do buyers need flexible Vitamin A payment?

Is a large, upfront payment straining your company's finances? Inflexible payment terms can be a major drag on your business.

Buyers need flexible payment options to manage their cash flow effectively. High-value Vitamin A orders can tie up significant capital, so terms that align payment with the shipment of goods help free up funds for other operational needs.

A large Vitamin A order1 is a significant investment. When you pay a large deposit upfront, that cash is tied up for months, unable to be used for other business needs. Flexible payment terms2—such as paying the balance upon shipment or after arrival—allow you to keep your cash working for you longer. It also reduces your risk, as it ensures the supplier must fulfill their obligations before they receive their full payment.

Cash Flow Impact of Payment Terms (on a $100,000 order):

| Payment Term | Upfront Cash Outlay | Final Cash Outlay (after 45 days) | Impact on Buyer's Cash Flow |

|---|---|---|---|

| 100% T/T in Advance | $100,000 | $0 | Very High Negative Impact |

| 30% Deposit, 70% Balance | $30,000 | $70,000 | Moderate, balanced impact |

What are common payment terms for Vitamin A?

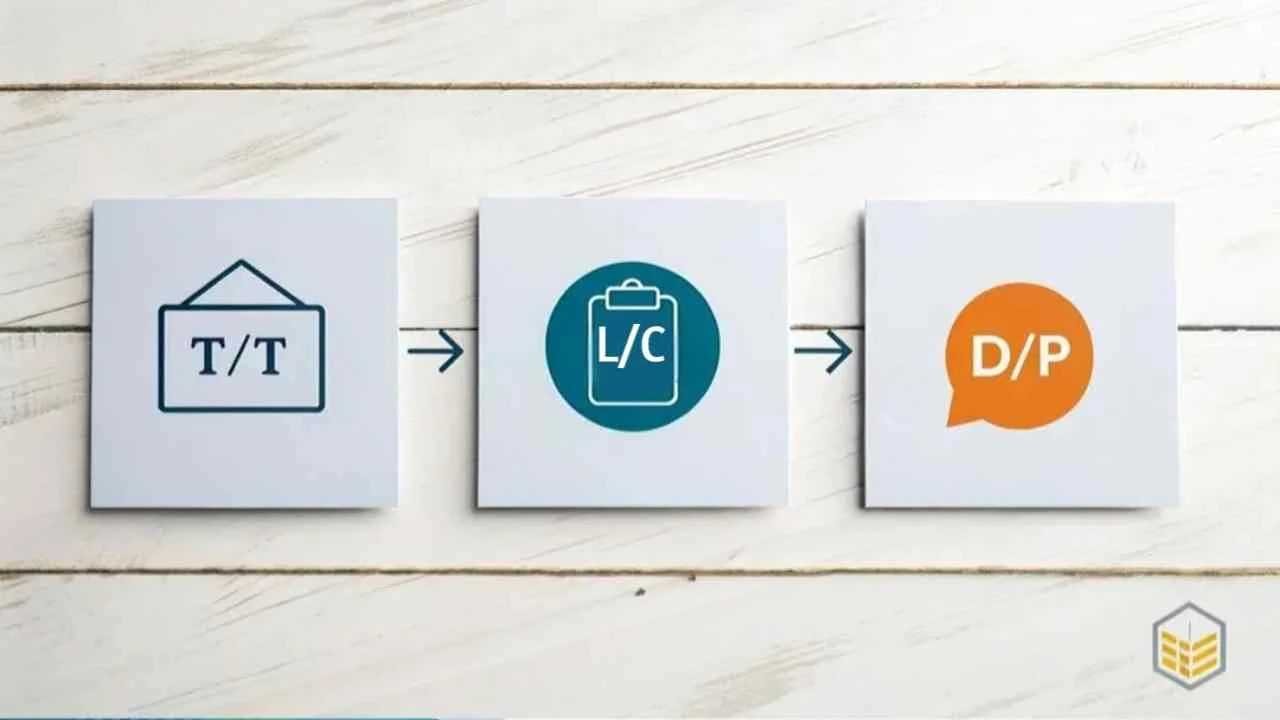

You see terms like T/T, L/C, and D/P. What do they really mean, and which one is right for you?

The most common payment term is Telegraphic Transfer (T/T), typically a 30% deposit and 70% balance. For higher security, a Letter of Credit (L/C) is used. Documents against Payment (D/P) offers a middle ground, balancing risk for both parties.

The industry standard is Telegraphic Transfer (T/T), with a 30% deposit to start production and a 70% balance payment against a copy of the shipping documents. This method shares the risk fairly. Documents against Payment (D/P) is more secure, as your bank only releases the payment once they receive the shipping documents from the supplier's bank. For long-term partners, Open Account (O/A) allows you to pay after receiving the goods, but this is reserved for relationships with a strong history of trust.

Payment Term Risk Comparison:

| Payment Term | Buyer's Risk | Seller's Risk | Best Use Case |

|---|---|---|---|

| 30/70 T/T Split | Medium | Medium | The most common standard for regular business. |

| D/P | Low | Medium | Good balance of security for both sides. |

| O/A | Very Low | Very High | Long-term, highly trusted partnerships. |

How do letters of credit secure Vitamin A?

Are you worried about sending a huge payment to a supplier for the first time? A Letter of Credit is designed to solve this problem.

A Letter of Credit (L/C) is a formal guarantee from the buyer's bank to the seller. The bank promises to pay, but only if the seller presents a specific set of perfectly compliant documents that prove the goods have been shipped as agreed.

A Letter of Credit3 (L/C) is the ultimate security tool. Your bank guarantees payment to us, but only if we provide a perfect set of documents (Bill of Lading, COA, etc.) exactly as specified in the L/C. This protects you from non-shipment and protects us from non-payment. However, L/Cs are slow, expensive, and extremely strict about paperwork. They are best for very large initial orders, after which most partners move to simpler T/T payments4.

Pros and Cons of a Letter of Credit (L/C):

| Pros | Cons |

|---|---|

| Very high security for both buyer and seller. | Expensive (high bank fees for both parties). |

| Protects the buyer from non-shipment. | Slow and complex administrative process. |

How do installment plans help Vitamin A buyers?

A large, one-time payment for a bulk order is straining your cash flow. Is there a way to spread out the cost?

For trusted, high-volume clients with annual contracts, suppliers can offer installment plans. This allows the buyer to pay for large quantities of Vitamin A in smaller, scheduled payments over the year, dramatically improving their cash flow management.

Installment plans5 are a feature of a true partnership. If you commit to a large annual volume via a contract, we can arrange for scheduled deliveries6 (e.g., one container per quarter). Instead of one massive upfront payment, you pay for each shipment as it goes, often after it has arrived. This gives you the price benefit of bulk buying while keeping your cash flow smooth and predictable. This level of flexibility is built on a foundation of long-term trust and a solid payment history.

Single Payment vs. Installment Plan (for a 12-ton annual purchase):

| Payment Model | Payment Structure | Impact on Buyer's Cash Flow |

|---|---|---|

| Single Bulk Order | One very large payment at the time of shipment. | Massive one-time cash outflow. |

| Annual Contract with Installments | Four smaller, predictable payments spread over the year. | Smooth, manageable, and predictable cash flow. |

How can suppliers gain trust with new Vitamin A buyers?

You have found a new supplier, but you are hesitant to send that first deposit. How can you be sure they are legitimate?

A good supplier builds trust by being transparent and reducing the buyer's initial risk. This means proactively providing company verification documents, welcoming third-party inspections, and being flexible on the first order's payment terms, such as accepting a smaller deposit.

It is my job as the supplier to earn your trust. A reliable partner will be an open book. I proactively provide new clients with our business licenses and quality certificates. I strongly encourage them to use third-party inspections (like SGS) to verify quality before final payment. For a first order, I am also willing to be flexible on the deposit amount to lower the buyer's initial risk. These actions show we are confident in our product and committed to building a long-term partnership, not just making a quick sale.

Trust-Building Checklist for Buyers:

| Action from Supplier | What it Signals to the Buyer |

|---|---|

| Proactively provides all business documents. | Transparency and professionalism. |

| Welcomes a third-party inspection. | Confidence in their own product quality. |

| Offers flexible deposit on the first order. | Willingness to share risk and build a partnership. |

Conclusion

The right payment option balances security, cash flow, and trust. A flexible supplier who understands your needs is key to building a successful, long-term partnership.

-

Learn about the implications and financial considerations of investing in large Vitamin A orders. ↩

-

Explore how flexible payment terms can enhance cash flow and reduce financial risk for your business. ↩

-

Understanding Letters of Credit is crucial for secure transactions in international trade. ↩

-

Exploring T/T payments can help you find more efficient payment methods for your business. ↩

-

Explore how installment plans can enhance cash flow and strengthen business relationships. ↩

-

Learn about the advantages of scheduled deliveries for better inventory management and cost savings. ↩