Struggling to find reliable ascorbic acid suppliers that balance cost and quality? As a B2B food additives specialist, I’ve navigated these challenges daily for global clients.

Top ascorbic acid sourcing regions include China (90% global production), Europe (high-purity grades), and India (cost-competitive options). Prioritize manufacturers with pharma-grade certifications and transparent supply chains.

Let’s analyze key considerations for sourcing this essential vitamin C form in 2024’s volatile market.

How to Identify Reputable Ascorbic Acid Manufacturers in China?

Fake certifications and subpar purity plague 1 in 3 Chinese suppliers. Cut risks with these verification steps.

Reputable manufacturers hold ISO 22000, FSSC 22000, or USP certifications. Audit their fermentation facilities (corn vs. wheat substrates), and request third-party COAs for heavy metals (<1ppm lead).

Key Selection Criteria

| Factor | Red Flags | Green Flags |

|---|---|---|

| Certifications | Only ISO 9001 | ISO 22000 + Halal/Kosher |

| Production Capacity | <100 tons/month | 500+ tons/month with JIT options |

| Testing | In-house only | SGS/Bureau Veritas reports |

| Logistics | No bonded warehouse | Dubai/ROTTERDAM hubs pre-stock |

What Should You Prioritize When Choosing a Supplement Wholesaler?

Are wholesale discounts hiding compromised quality? Price matters, but these factors protect your brand.

Prioritize: batch-specific COAs (>99% purity), cold chain logistics for stability, and multi-format packaging (50kg drums to retail sachets). Avoid vendors without HACCP/GMP compliance.

Wholesaler Evaluation Matrix

| Criteria | Weight | Example Metrics |

|---|---|---|

| Certification Depth | 30% | FDA/EMA/EU Organic |

| Supply Chain Transparency | 25% | Live fermentation tank cameras |

| Crisis Response | 20% | 48hr replacement guarantees |

| Payment Terms | 15% | 30% deposit, 70% post-inspection |

| MOQ Flexibility | 10% | 500kg vs. standard 5-ton MOQs |

Who Manufactures Private-Label Vitamins?

Private-label vitamins1 combine scientific rigor with brand flexibility—here’s who’s leading the industry with specialized formulations and compliance expertise2.

Top manufacturers include CY Trading Ltd (UK), TheNewVitaminStop (USA), Beauty Private Label (USA), and Health Sources Nutrition (China). They offer end-to-end solutions from formulation to export documentation, with MOQs starting at 500 units.

Manufacturer Comparison

| Company | Key Strengths | Target Markets |

|---|---|---|

| CY Trading Ltd | ISO 9001/GMP-certified, 50+ years’ experience | EU/UK retailers, Halal foods |

| TheNewVitaminStop | 200+ SKUs (mushrooms, antioxidants, keto) | US supplement stores |

| Beauty Private Label | Clean skincare-nutrition integrations | Beauty supplements |

| Health Sources Nutrition | Custom formulation support, China-market access | Global distributors |

CY Trading Ltd helped a German organic brand launch a vegan vitamin D33 line in 6 weeks—complete with EU-compliant packaging and bilingual labeling. Beauty Private Label reduced a California startup’s R&D costs by 40% through pre-formulated “skin-gut axis4” supplement blends.

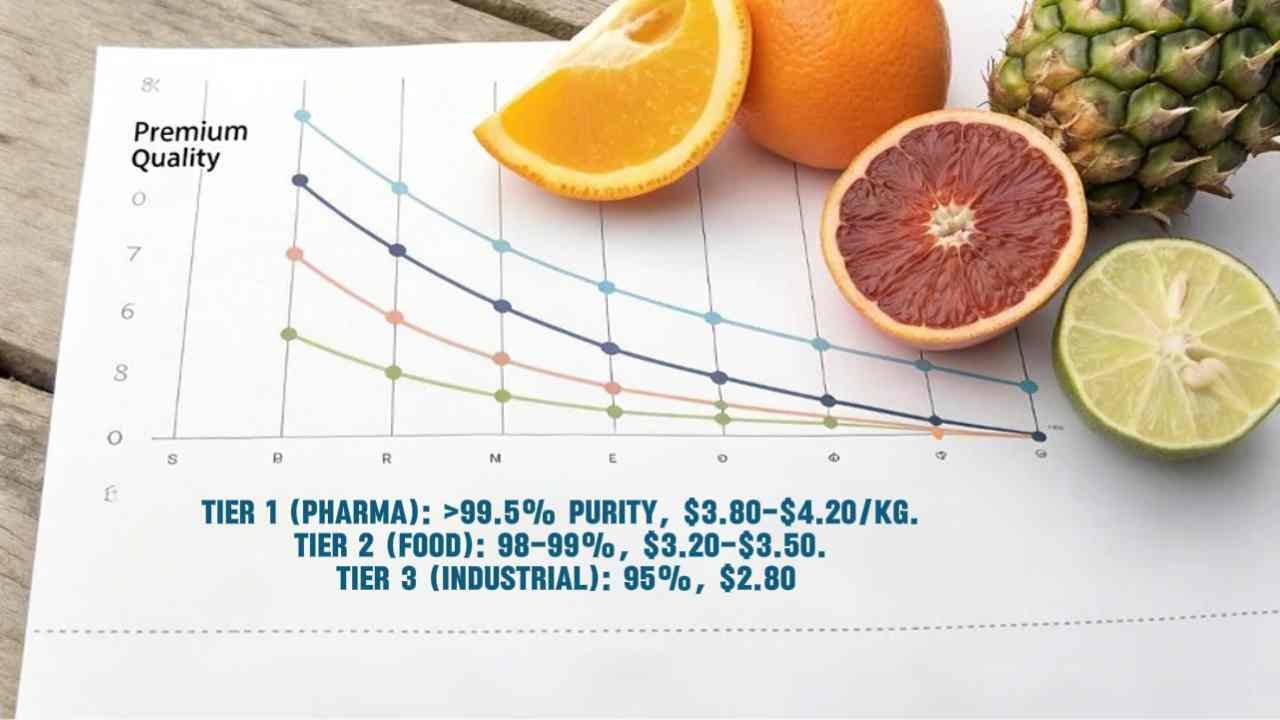

How to Balance Cost and Quality in Bulk Ascorbic Acid Purchases?

Saving $0.10/kg could cost $100K in recalls. Use these tiered sourcing strategies5.

Tier 1 (Pharma): >99.5% purity, $3.80-$4.20/kg. Tier 2 (Food): 98-99%, $3.20-$3.50. Tier 3 (Industrial): 95%, $2.80 but risk 15% impurities.

Cost Optimization Tactics

| Strategy | Savings | Risk Mitigation |

|---|---|---|

| Annual Contracts | 12-18% | Price escalation clauses |

| Bulk Blending | 8% | Pre-mix stability testing |

| Nearshoring | 5% | Dual sourcing from China/EU |

Vietnamese buyers cut total costs 15% by splitting orders: Pharma-grade for supplements + industrial-grade for preserved meats.

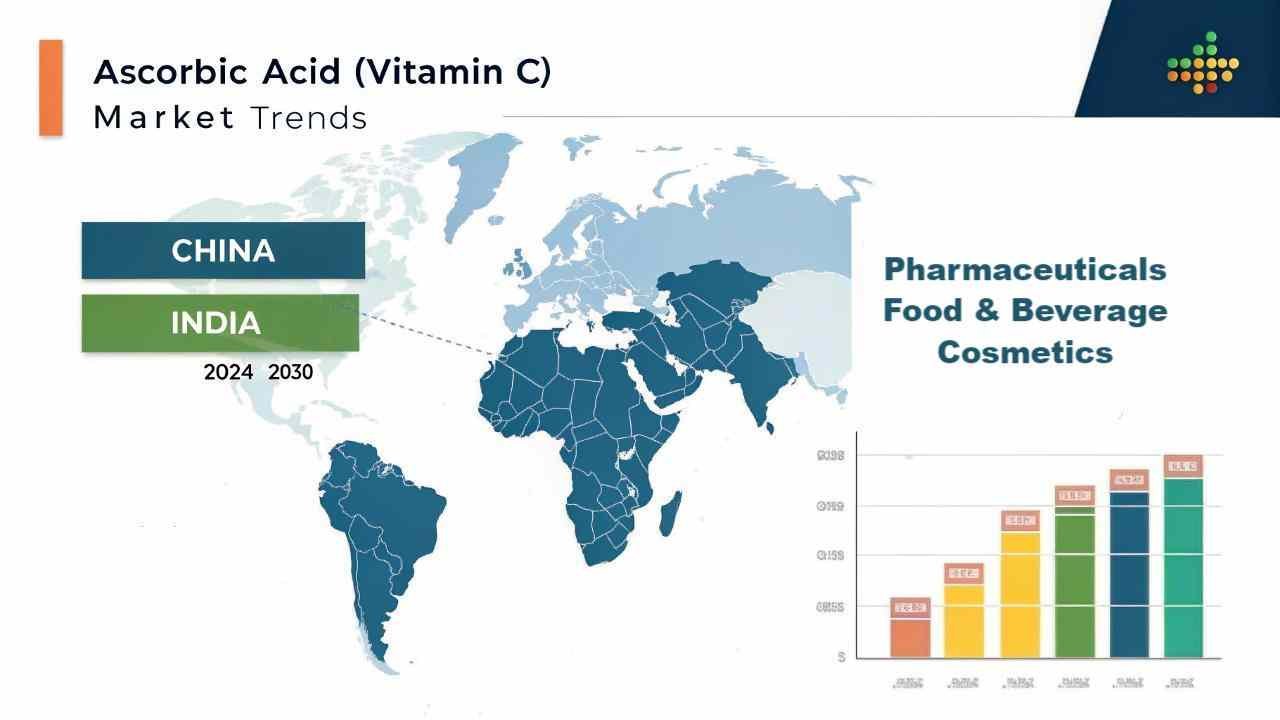

What market trends will affect the price of ascorbic acid?

The ascorbic acid market is currently experiencing significant shifts driven by a mix of regulatory, commodity, and technological trends. These trends not only impact production capacity but also influence raw material costs and quality standards, ultimately affecting overall pricing dynamics.

Key market trends include: - Chinese Environmental Regulations: Stricter policies have led to a 20% reduction in production capacity, creating supply constraints. - Raw Material Price Volatility: Corn prices, a key feedstock, have surged by 34% year-to-date, pushing up production costs. - New Global Purity Standards:Enhanced purity requirements, particularly in the EU, necessitate costly process updates and impact pricing.

Ascorbic Acid Price Impact Comparison

| Trend | Impact on Price | Key Regions/Drivers |

|---|---|---|

| Environmental Regulations | 20% production capacity reduction | China, EU |

| Raw Material Volatility | 34% increase in corn prices affecting costs | Global commodity markets |

| Purity Standards | Increased processing and compliance costs | EU and other regulated markets |

Conclusion

Sourcing ascorbic acid profitably requires combining market intelligence with supplier due diligence. Our China-based network delivers pharma-grade quality at industrial prices through scale and vertical integration.

-

Explore this link to understand how private-label vitamins can offer unique advantages in quality and branding. ↩

-

Discover the significance of compliance expertise in ensuring product safety and regulatory adherence in the vitamin market. ↩

-

Explore this link to understand the health benefits and importance of vegan vitamin D3 for your wellness journey. ↩

-

Discover the connection between skin health and gut health, and why it matters for your well-being. ↩

-

Explore this link to understand the concept of tiered sourcing strategies and how they can optimize procurement processes. ↩