Are you unprepared for the next Vitamin A price shock? A sudden supply crisis can halt your production and destroy your budget. Ignoring these risks is a dangerous strategy.

Risk management is essential because the Vitamin A market is extremely volatile. Proactive strategies are needed to protect your company from supply disruptions, price spikes, quality failures, and currency fluctuations, ensuring business continuity and profitability.

A professional buyer knows that in the Vitamin A market, the risks are real. A "buy and hope" strategy is not enough. Instead, a clear risk management plan is essential. Let's look at the key risks and how you can control them.

What risks affect Vitamin A supply?

Is your supply chain built on a single point of failure? A fire at one factory thousands of miles away could be enough to shut you down.

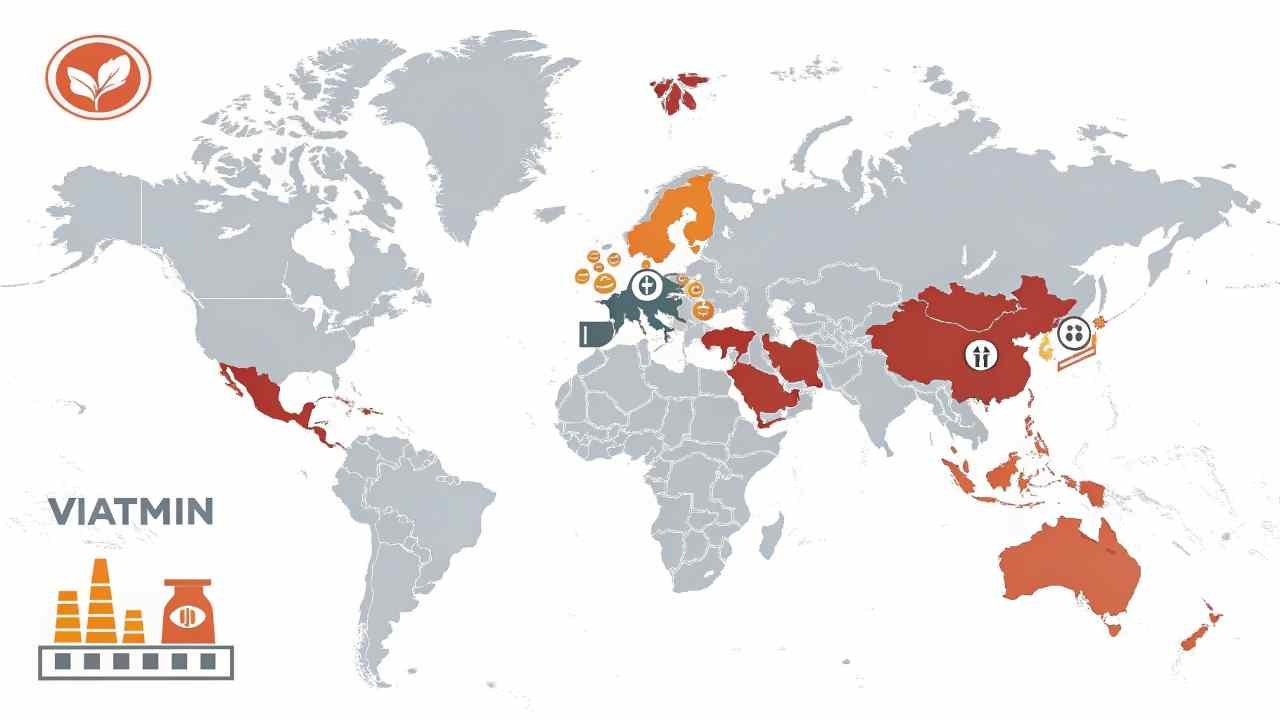

The two biggest risks are supply concentration and raw material dependency. The global supply comes from only a few factories, making it vulnerable to shutdowns. It also depends on petrochemicals, so oil price volatility directly impacts cost and availability.

The Vitamin A market is inherently unstable. First, the supply is highly concentrated1 in a handful of factories. An accident at just one of these plants (like the BASF fire in 2017) can trigger a global shortage and extreme price spikes. Second, its production is dependent on petrochemicals2. This means the price and availability of Vitamin A are directly linked to the volatile crude oil market. These two factors create a constant risk of price and supply shocks.

Vitamin A Supply Risk Matrix:

| Risk Type | Cause | Impact |

|---|---|---|

| Supply Concentration | Accident or shutdown at one of the few key factories. | Sudden, extreme price spikes and severe shortages. |

| Raw Material Dependency | Fluctuation in the price and availability of petrochemicals. | Gradual price increases, potential for tight supply. |

How does currency affect Vitamin A trade?

You agreed on a price, but by the time you pay, your cost has gone up. Currency fluctuations can be a hidden tax on your international orders.

Currency fluctuations are a major financial risk. The trade is typically priced in US Dollars (USD). If your local currency weakens against the USD between the order date and the payment date, the effective cost of the Vitamin A will increase.

When you buy from China, the price is almost always in US Dollars. However, you pay in your local currency. If your currency weakens against the USD between the time you place the order and the time you pay, the final cost to you goes up. For example, a $100,000 USD invoice could cost you 375,000 in your local currency one day, but 380,000 two months later. This is a real financial risk that must be accounted for in your budget.

Currency Fluctuation Example ($100,000 USD order):

| Scenario | Exchange Rate (Local Currency to USD) | Final Cost in Local Currency | Impact on Buyer |

|---|---|---|---|

| At Time of Order | 3.75 | 375,000 | Baseline expected cost. |

| At Time of Payment (Weak Currency) | 3.80 | 380,000 | Cost increases by 5,000. |

Why diversify Vitamin A suppliers?

Is your entire business dependent on a single supplier? What if they have a quality problem, a production delay, or a massive price increase?

Diversifying suppliers is a fundamental risk management strategy. Relying on a single source creates a critical vulnerability. Having at least two qualified suppliers from different regions provides a backup, increases your negotiating power, and protects you from single-point failures.

"Don't put all your eggs in one basket" is critical advice for Vitamin A. Having a second qualified supplier is your insurance policy3. If your main supplier has a major problem, you can immediately shift your orders to your backup and keep your production running. Diversification also gives you negotiating leverage4, as it keeps your primary supplier's pricing competitive. A smart strategy is to qualify one supplier in China and another in Europe to diversify your geographic risk as well.

Single Sourcing vs. Diversified Sourcing:

| Aspect | Single Sourcing | Diversified Sourcing (2+ Suppliers) |

|---|---|---|

| Supply Security | Very High Risk. A single failure stops you. | High. You have a backup plan. |

| Price Leverage | Low. The supplier has all the power. | High. You can use competition to your advantage. |

How do contracts reduce Vitamin A risk?

Are you tired of being at the mercy of the volatile spot market? Does every price increase force a crisis in your budget?

Long-term contracts are a powerful risk management tool because they transfer risk from the buyer to the supplier. A contract locks in a fixed price and a guaranteed volume, protecting you completely from price volatility and supply shortages.

A long-term contract is the best way to create stability. It provides two critical protections. First, it locks in your price5 for the entire year, making you immune to market spikes and allowing for perfect budget predictability. Second, it guarantees your supply6. In a market shortage, factories will always serve their contract customers first. Spot buyers are the last in line. A contract moves you to the front of the line, ensuring your business continuity.

Risk Profile: Spot Buying vs. Contract Buying:

| Risk Type | Spot Buying | Long-Term Contract |

|---|---|---|

| Price Risk | Very High. Fully exposed to market spikes. | Zero. The price is fixed. |

| Supply Risk | High. Last priority during a shortage. | Very Low. You are the first priority. |

How to secure Vitamin A in emergencies?

A global supply crisis has just hit. Prices are skyrocketing, and suppliers are sold out. What is your plan?

You secure Vitamin A in an emergency by having a pre-planned strategy. The two most effective tactics are maintaining a strategic safety stock (inventory) and leveraging a strong relationship with a loyal, long-term supplier who will prioritize your needs.

A crisis is not the time to start planning. You need a strategy in place. Your first line of defense is a strategic safety stock. Holding 1-3 months of inventory allows you to continue production while you wait for market panic to subside. Your second line of defense is a strong partnership. In a crisis, suppliers will always prioritize their loyal, long-term customers. This priority access is an invaluable benefit that ensures you get a supply when others cannot.

Emergency Preparedness Level:

| Preparedness Level | Strategy Employed | Outcome During a Supply Crisis |

|---|---|---|

| Unprepared | Just-in-Time, transactional relationships. | Production halt, forced to pay extreme spot prices. |

| Very Prepared | Safety Stock + Strong Partnership | Maintains production and gets priority access to new supply. |

Conclusion

Risk management for Vitamin A is not optional; it is essential. Through diversification, contracts, and strong partnerships, you can protect your business from the market's inherent volatility.

-

Understanding this term can help you grasp the risks associated with supply chain vulnerabilities. ↩

-

Exploring this link will provide insights into market dynamics and potential future trends. ↩

-

Understanding the role of an insurance policy can help you mitigate risks in your supply chain effectively. ↩

-

Exploring this topic can enhance your negotiation skills and improve supplier relationships for better pricing. ↩

-

Exploring this link will help you understand how price stability can enhance your budgeting and financial planning. ↩

-

This resource will explain the importance of supply guarantees and how they can protect your business during shortages. ↩